Page 315 - Insurance Statistics 2021

P. 315

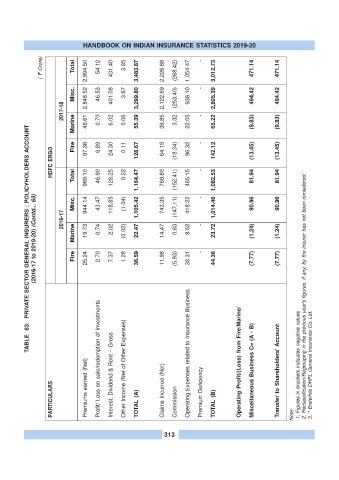

HANDBOOK ON INDIAN INSURANCE STATISTICS 2019-20

( ? Crore) Total 2,994.50 54.12 431.40 3.85 3,483.87 2,226.68 (268.42) 1,054.47 - 3,012.73 471.14 471.14

Misc. 2,848.52 46.53 401.08 3.67 3,299.80 2,122.69 (253.40) 936.10 - 2,805.39 494.42 494.42

2017-18 -

Marine 48.61 0.70 6.02 0.06 55.39 39.85 3.32 22.05 65.22 (9.83) (9.83)

TABLE 63: PRIVATE SECTOR GENERAL INSURERS : POLICYHOLDERS ACCOUNT

HDFC ERGO Fire Total 97.36 989.10 6.89 46.90 24.30 128.25 0.11 0.22 128.67 1,164.47 64.15 769.80 (18.34) (152.41) 96.32 465.15 - - - 142.12 1,082.53 (13.45) 81.94 (13.45) 81.94

(2016-17 to 2019-20) (Contd... 63) 2016-17 Misc. Marine Fire 944.14 19.73 25.24 43.47 0.74 2.70 118.85 2.02 7.37 (1.04) (0.02) 1.28 1,105.42 22.47 36.59 743.35 14.47 11.98 (147.11) 0.63 (5.93) 418.22 8.62 38.31 - - 1,014.46 23.72 44.36 90.96 (1.24) (7.77) 90.96 (1.24) (7.77) 2. Reclassification/Regrouping in the previous year's figures, if any, by the insurer has not been considered.

PARTICULARS Premiums earned (Net) Profit/ Loss on sale/redemption of Investments Interest, Dividend & Rent – Gross Other Income (Net of Other Expenses) TOTAL (A) Claims Incurred (Net) Commission Operating Expenses related to Insurance Business Premium Deficiency TOTAL (B) Operating Profit/(Loss) from Fire/Marine/ Miscellaneous Business C= (A - B) Transfer to Shareholders’ Account Note: 1. Figures in brackets indicates negative values 3. * Er

313