Page 641 - Insurance Statistics 2021

P. 641

HANDBOOK ON INDIAN INSURANCE STATISTICS 2019-20

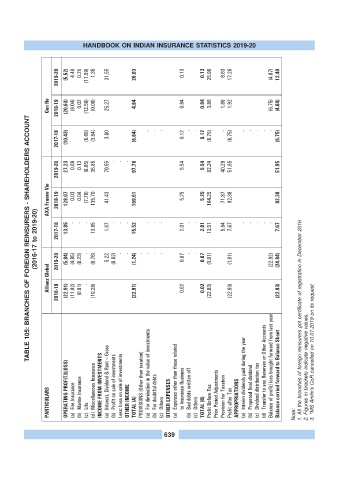

2019-20 (5.52) 4.48 0.25 (11.59) 1.35 31.55 26.03 0.13 0.13 25.90 8.63 17.26 (4.87) 12.40

Gen Re 2018-19 (20.63) (8.04) 0.02 (12.56) (0.06) 25.27 4.64 0.84 0.84 3.80 1.88 1.92 (6.75) (4.84)

TABLE 105: BRANCHES OF FOREIGN REINSURERS - SHAREHOLDERS ACCOUNT

2017-18 (10.43) (6.60) (3.84) 3.80 (6.64) - - - 0.12 - - 0.12 (6.75) - (6.75) - - - - - (6.75)

2019-20 27.23 0.09 0.13 (8.85) 35.85 70.55 - - - 97.78 5.54 5.54 92.24 40.29 51.95 51.95

AXA France Vie 2018-19 128.07 0.03 0.04 (7.70) 135.70 41.43 169.51 5.25 5.25 164.25 71.87 92.38 92.38

(2016-17 to 2019-20) 2017-18 13.85 - - - - 13.85 1.67 5.22 - - - - - 15.52 - - - - - - - 2.01 0.67 - - - - 2.01 0.67 13.51 5.84 7.67 - - - - - 7.67

Allianz Global 2019-20 2018-19 (5.84) (22.91) (4.85) (11.82) (0.23) (0.81) - (0.76) (10.28) (0.62) (1.24) (22.91) 0.02 0.02 (1.91) (22.93) (1.91) (22.93) (22.92) (24.84) (22.93) 1. All the branches of foreign reinsurers got certificate of registration in December 2016

PARTICULARS OPERATING PROFIT/(LOSS) Fire Insurance (a) Marine Insurance (b) Life (c) Miscellaneous Insurance (d ) INCOME FROM INVESTMENTS Interest, Dividend & Rent – Gross (a) Profit on sale of investments (b) Less: Loss on sale of investments OTHER INCOME TOTAL (A) PROVISIONS (Other than taxation) For diminution in the value of investments (a) For doubtful debts (b) Others (c) OTHER EXPENSES Expenses other than those related (a) to

639