Page 651 - Insurance Statistics 2021

P. 651

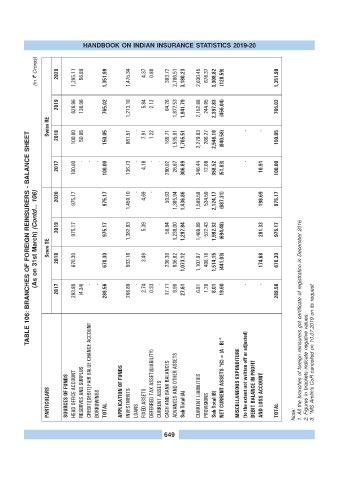

HANDBOOK ON INDIAN INSURANCE STATISTICS 2019-20

(in ? Crores) 2020 1,295.11 56.89 1,351.99 1,475.34 4.37 0.88 393.72 2,786.51 3,180.23 2,630.45 678.37 3,308.82 (128.59) 1,351.99

2019 626.96 138.06 765.02 1,213.10 5.84 2.12 64.26 1,877.53 1,941.79 2,152.88 244.95 2,397.83 (456.04) 765.02

Swiss RE 2018 100.00 50.05 150.05 981.51 - 7.91 1.22 169.71 1,535.81 1,705.51 2,279.83 266.27 2,546.10 (840.58) - - 150.05

TABLE 106: BRANCHES OF FOREIGN REINSURERS - BALANCE SHEET

2017 2020 100.00 975.17 - - - 100.00 975.17 136.73 1,459.10 - - 4.18 4.69 - - - 280.02 50.93 26.67 1,385.94 306.69 1,436.86 346.44 1,589.58 12.08 534.59 358.52 2,124.17 (51.83) (687.31) - 10.91 198.69 100.00 975.17

(As on 31st March) (Contd... 106) Score SE 2019 2018 975.17 670.30 975.17 670.30 1,382.93 933.16 5.39 3.49 58.84 236.30 1,239.00 836.82 1,297.84 1,073.12 1,469.89 1,107.97 522.43 406.18 1,992.32 1,514.15 (694.48) (441.03) 281.33 174.68 975.17 670.30

2017 293.80 (4.24) - - 289.56 266.89 - 2.74 0.33 - 17.71 9.90 27.61 6.81 1.20 8.01 19.60 - - 289.56 1. All the branches of foreign reinsurers got certificate of registration in December 2016

PARTICULARS SOURCES OF FUNDS HEAD OFFICE ACCOUNT RESERVES AND SURPLUS CREDIT/[DEBIT] FAIR VALUE CHANGE ACCOUNT BORROWINGS TOTAL APPLICATION OF FUNDS INVESTMENTS LOANS FIXED ASSETS DEFERRED TAX ASSET/(LIABILITY) CURRENT ASSETS CASH AND BANK BALANCES ADVANCES AND OTHER ASSETS Sub-Total (A) CURRENT LIABILITIES PROVISIONS Sub-Total (B) NET CURRENT ASSETS “(C) = (A - B) " MISCELLANEOUS EXPENDITURE (to the extent not written off or adjusted) DE

649