Page 804 - Insurance Statistics 2021

P. 804

Indian Non-life Insurance Industry

Yearbook 2018-19

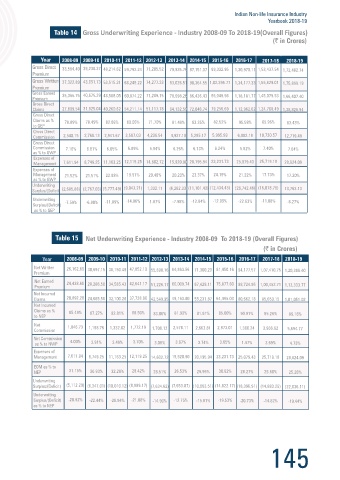

Gross Underwriting Experience - Industry 2008-09 To 2018-19(Overall Figures)

Year 2017-18 2018-19

Year 2017-18 2018-19

4.1% 6.6% 33,564.40 39,238.37 48,214.62 59,792.24 71,205.52 79,935.76 87,151.37 99,332.95 1,30,970.11 1,53,437.54 1,72,482.74

3.1% 1.3%

12.4% 13.5% 37,322.89 43,651.73 53,515.31 68,249.22 74,277.33 83,026.51 90,364.55 1,02,395.77 1,34,177.33 1,56,629.01 1,75,899.19

1.6% 1.4% Gross Earned 35,365.75 40,675.39 48,588.05 60,874.22 71,289.15 78,698.26 86,436.43 96,049.98

14.5% 17.0% Premium 1,18,181.77 1,45,079.53 1,66,407.40

-1.0% 0.6% Gross Direct 27,899.54 31,925.04 40,260.62 54,211.14 51,117.78 64,132.59 72,046.74 79,256.69 1,12,962.62 1,24,708.49 1,38,826.94

Claims

11.1% 4.6% Gross Direct

4.3% 4.1% Claims as % 78.89% 78.49% 82.86% 89.05% 71.70% 81.49% 83.35% 82.52% 95.58% 85.96% 83.43%

3.0% 1.4% to GEP

14.3% 12.2% Gross Direct 2,540.15 2,768.13 2,941.67 3,587.03 4,236.54 4,927.10 5,295.17 5,995.99 6,882.19 10,730.57 12,719.49

Commission

-10.6% -7.6% Gross Direct

3.9% 5.0% Commission 7.18% 6.81% 6.05% 5.89% 5.94% 6.26% 6.13% 6.24% 5.82% 7.40% 7.64%

as % to GWP

Expenses of

GENERAL INSURERS Management 7,611.94 8,749.25 11,163.25 12,119.25 14,602.72 15,920.90 20,195.94 23,231.73 25,079.43 25,719.18 28,624.09

Expenses of

Year 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18 2018-19 Management 21.52% 21.51% 22.98% 19.91% 20.48% 20.23% 23.37% 24.19% 21.22% 17.73% 17.20%

1.1% 1.1% 4.2% 5.6% 5.9% 6.1% 9.2% 8.6% 6.2% 4.1% 6.6% as % to GWP

-17.5% -14.6% -9.8% -0.2% -12.9% 0.0% -3.1% -2.0% -2.3% 3.1% 1.3% Underwriting (2,685.88) (2,767.03) (5,777.49) (9,043.21) 1,332.11 (6,282.33) (11,101.43) (12,434.43) (26,742.46) (16,078.70) 13,763.13

Surplus/(Deficit)

9.4% 8.8% 9.7% 9.4% 11.8% 10.9% 10.5% 10.7% 10.1% 12.4% 13.5%

-35.7% -19.6% -14.2% -18.4% -7.1% -3.6% -4.9% -3.2% -1.6% 1.6% 1.4% Underwriting -7.59% -6.80% -11.89% -14.86% 1.87% -7.98% -12.84% -12.95% -22.63% -11.08% -8.27%

7.2% 7.9% 6.5% 6.6% 7.5% 7.8% 6.2% 6.7% 6.2% 14.5% 17.0% Surplus/(Deficit)

as % to GEP

-1.6% -1.4% -0.6% 1.0% -1.5% -0.7% -0.5% -0.4% -1.1% -1.0% 0.6%

0.5% 15.6% 14.5% 13.0% 9.6% 2.9% 10.3% 7.4% 11.2% 11.1% 4.6%

8.7% 7.3% 5.7% 5.4% 4.0% 4.8% 5.1% 5.2% 3.3% 4.1% 3.4%

9.3% 8.7% 9.5% 8.8% 9.2% 8.3% 8.3% 5.1% 3.6% 2.9% 0.9% Net Underwriting Experience - Industry 2008-09 To 2018-19 (Overall Figures)

13.6% 11.8% 12.2% 11.8% 12.7% 14.5% 14.9% 13.6% 12.6% 14.3% 12.2%

11.2% 10.4% 5.5% 7.8% 2.6% 4.0% -2.1% 0.4% -12.1% -6.4% -6.0%

4.8% 4.9% 4.6% 5.2% 4.0% 4.8% 4.1% 4.3% 2.2% 4.6% 5.4%

Y

Year 2017-18 2018-19

ear

Net Written 26,162.69 30,697.15 38,150.49 47,852.19 55,890.16 64,863.56

STANDALONE HEALTH INSURERS Premium 71,300.23 81,450.16 94,177.57 1,07,410.75 1,20,386.40

Year 2017-18 2018-19 Net Earned 24,438.66 28,286.56 34,585.43 42,641.17 51,226.17 60,009.74

5% 6.3% Premium 67,428.11 75,877.60 88,724.95 1,00,452.71 1,13,333.77

4% 5.8% Net Incurred 20,892.28 24,685.56 32,100.28 37,738.90 42,549.95 49,163.80

6% - Claims 55,231.87 64,495.03 80,662.18 85,650.15 1,01,051.02

5% 6.3% Net Incurred

Claims as % 85.49% 87.27% 92.81% 88.50% 83.06% 81.93% 81.91% 85.00% 90.91% 85.26%

to NEP 89.16%

SPECIALISED INSURERS

Net 1,046.73 1,198.76 1,332.02 1,772.19 2,578.11 2,663.81 2,973.01 1,380.24 3,966.62

Year 2017-18 2018-19 Commission 1,708.13 5,694.77

-22.9% -12.6% Net Commission

as % to NWP 4.00% 3.91% 3.49% 3.70% 3.06% 3.97% 3.74% 3.65% 1.47% 3.69% 4.73%

Source : IRDAI reports and Council Compilation

Expenses of

Management 7,611.94 8,749.25 11,163.25 12,119.25 14,602.72 15,920.90 20,195.94 23,231.73 25,079.43 25,719.18 28,624.09

EOM as % to

NEP 31.15% 30.93% 32.28% 28.42% 28.51% 26.53% 29.95% 30.62% 28.27% 25.60% 25.26%

Underwriting

Surplus/(Deficit) (5,112.29) (6,347.01) (10,010.12) (8,989.17) (7,634.62) (7,653.07) (10,663.51) (14,822.17) (18,396.91) (14,883.25) (22,036.11)

Underwriting

Surplus/(Deficit) -20.92% -22.44% -28.94% -21.08% -14.90% -12.75% -15.81% -19.53% -20.73% -14.82% -19.44%

as % to NEP

144 145