Page 54 - Food Outlook

P. 54

MEAT AND MEAT PRODUCTS

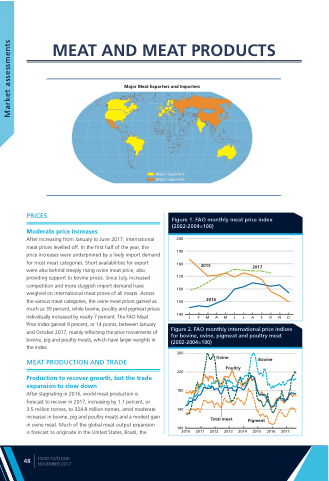

Major Meat Exporters and Importers

Market assessments

PRICES

Moderate price increases

Major Exporters Major Importers

Figure 1. FAO monthly meat price index (2002-2004=100)

2017

After increasing from January to June 2017, international

meat prices levelled off. In the first half of the year, the

price increases were underpinned by a lively import demand

for most meat categories. Short availabilities for export

were also behind steeply rising ovine meat price, also

providing support to bovine prices. Since July, increased

competition and more sluggish import demand have

weighed on international meat prices of all meats. Across

the various meat categories, the ovine meat prices gained as 150 much as 39 percent, while bovine, poultry and pigmeat prices individually increased by nearly 7 percent. The FAO Meat

2015

2016

Price Index gained 9 percent, or 14 points, between January and October 2017, mainly reflecting the price movements of bovine, pig and poultry meats, which have larger weights in the index.

MEAT PRODUCTION AND TRADE

140 JFMAMJJASOND

Figure 2. FAO monthly international price indices for bovine, ovine, pigmeat and poultry meat (2002-2004=100)

Production to recover growth, but the trade

expansion to slow down

After stagnating in 2016, world meat production is

forecast to recover in 2017, increasing by 1.1 percent, or

3.5 million tonnes, to 324.8 million tonnes, amid moderate 140 increases in bovine, pig and poultry meats and a modest gain

Bovine

Pigmeat

2014 2015 2016 2017

in ovine meat. Much of the global meat output expansion is forecast to originate in the United States, Brazil, the

FOOD OUTLOOK NOVEMBER 2017

180

100

2010 2011

48

200

190

180

170

160

260

220

Ovine Poultry

Total meat

2012 2013