Page 60 - Food Outlook

P. 60

MILK AND MILK PRODUCTS

Major Dairy Exporters and Importers

Market assessments

PRICES

The price gap between butter and other dairy commodities widens

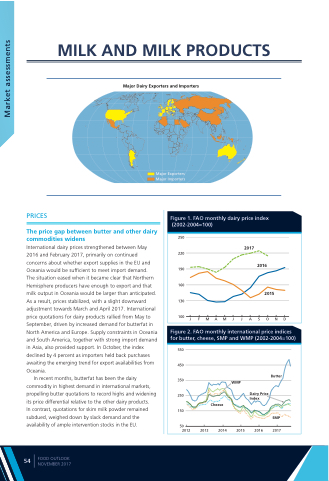

International dairy prices strengthened between May 2016 and February 2017, primarily on continued concerns about whether export supplies in the EU and Oceania would be sufficient to meet import demand. The situation eased when it became clear that Northern Hemisphere producers have enough to export and that milk output in Oceania would be larger than anticipated. As a result, prices stabilized, with a slight downward adjustment towards March and April 2017. International price quotations for dairy products rallied from May to September, driven by increased demand for butterfat in North America and Europe. Supply constraints in Oceania and South America, together with strong import demand in Asia, also provided support. In October, the index declined by 4 percent as importers held back purchases awaiting the emerging trend for export availabilities from Oceania.

Figure 1. FAO monthly dairy price index (2002-2004=100)

In recent months, butterfat has been the dairy

commodity in highest demand in international markets,

propelling butter quotations to record highs and widening 250 its price differential relative to the other dairy products.

In contrast, quotations for skim milk powder remained

subdued, weighed down by slack demand and the

availability of ample intervention stocks in the EU.

Butter

SMP

54

FOOD OUTLOOK NOVEMBER 2017

Major Exporters Major Importers

250 220 190 160 130

2017

2015

100 JFMAMJJASOND Figure 2. FAO monthly international price indices

for butter, cheese, SMP and WMP (2002-2004=100)

550

450

350

150

50

2012

WMP

2015

Dairy Price Index

2013

Cheese

2014

2016 2017

2016