Page 23 - A Level Business Studies - Financial Analysis Tasks

P. 23

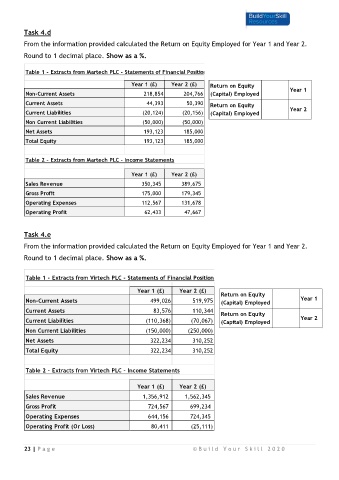

Task 4.d

From the information provided calculated the Return on Equity Employed for Year 1 and Year 2.

Round to 1 decimal place. Show as a %.

Table 1 - Extracts from Martech PLC - Statements of Financial Position

Year 1 (£) Year 2 (£) Return on Equity

Non-Current Assets 218,854 204,766 (Capital) Employed Year 1

Current Assets 44,393 50,390 Return on Equity Year 2

Current Liabilities (20,124) (20,156) (Capital) Employed

Non Current Liabilities (50,000) (50,000)

Net Assets 193,123 185,000

Total Equity 193,123 185,000

Table 2 - Extracts from Martech PLC - Income Statements

Year 1 (£) Year 2 (£)

Sales Revenue 350,345 389,675

Gross Profit 175,000 179,345

Operating Expenses 112,567 131,678

Operating Profit 62,433 47,667

Task 4.e

From the information provided calculated the Return on Equity Employed for Year 1 and Year 2.

Round to 1 decimal place. Show as a %.

Table 1 - Extracts from Virtech PLC - Statements of Financial Position

Year 1 (£) Year 2 (£) Return on Equity

Non-Current Assets 499,026 519,975 (Capital) Employed Year 1

Current Assets 83,576 110,344 Return on Equity

Current Liabilities (110,368) (70,067) (Capital) Employed Year 2

Non Current Liabilities (150,000) (250,000)

Net Assets 322,234 310,252

Total Equity 322,234 310,252

Table 2 - Extracts from Virtech PLC - Income Statements

Year 1 (£) Year 2 (£)

Sales Revenue 1,356,912 1,562,345

Gross Profit 724,567 699,234

Operating Expenses 644,156 724,345

Operating Profit (Or Loss) 80,411 (25,111)

23 | P a g e © B u i l d Y o u r S k i l l 2 0 2 0