Page 7 - Strategic Tax Planning for Global Commerce & Investment

P. 7

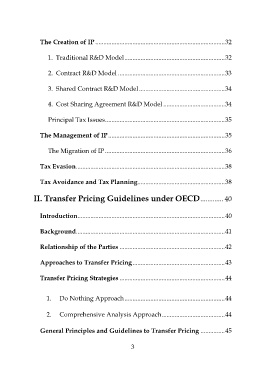

The Creation of IP ................................................................................ 32

1. Traditional R&D Model .............................................................. 32

2. Contract R&D Model .................................................................. 33

3. Shared Contract R&D Model ..................................................... 34

4. Cost Sharing Agreement R&D Model ...................................... 34

Principal Tax Issues .......................................................................... 35

The Management of IP ........................................................................ 35

The Migration of IP .......................................................................... 36

Tax Evasion ............................................................................................ 38

Tax Avoidance and Tax Planning...................................................... 38

II. Transfer Pricing Guidelines under OECD ............. 40

Introduction ........................................................................................... 40

Background ............................................................................................ 41

Relationship of the Parties ................................................................. 42

Approaches to Transfer Pricing ......................................................... 43

Transfer Pricing Strategies ................................................................. 44

1. Do Nothing Approach .............................................................. 44

2. Comprehensive Analysis Approach ....................................... 44

General Principles and Guidelines to Transfer Pricing ............... 45

3