Page 124 - DHC Budget Book 2021-22 Final

P. 124

INDIA BUDGET 2021-22

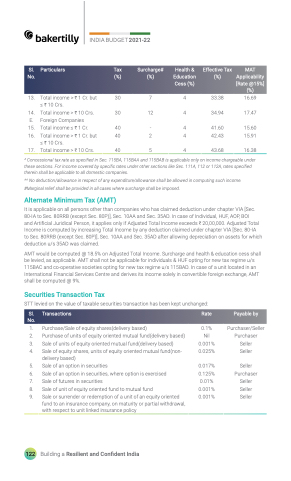

Sl. No.

Particulars

Tax (%)

Surcharge# (%)

Health & Education Cess (%)

Effective Tax (%)

MAT Applicability [Rate @15%] (%)

Total income > H 1 Cr. but ≤ H 10 Crs.

30

7

4

33.38

Total income > H 10 Crs.

30

12

4

34.94

Foreign Companies

Total income ≤ H 1 Cr.

40

-

4

41.60

Total income > H 1 Cr. but ≤ H 10 Crs.

40

2

4

42.43

Total income > H 10 Crs.

40

5

4

43.68

13.

16.69

14. 17.47

E.

15. 15.60

16.

15.91

17. 16.38

^ Concessional tax rate as specified in Sec. 115BA, 115BAA and 115BAB is applicable only on income chargeable under these sections. For income covered by specific rates under other sections like Sec. 111A, 112 or 112A, rates specified therein shall be applicable to all domestic companies.

^^ No deduction/allowance in respect of any expenditure/allowance shall be allowed in computing such income. #Marginal relief shall be provided in all cases where surcharge shall be imposed.

Alternate Minimum Tax (AMT)

It is applicable on all persons other than companies who has claimed deduction under chapter VIA [Sec. 80-IA to Sec. 80RRB (except Sec. 80P)], Sec. 10AA and Sec. 35AD. In case of Individual, HUF, AOP, BOI

and Artificial Juridical Person, it applies only if Adjusted Total Income exceeds H 20,00,000. Adjusted Total Income is computed by increasing Total Income by any deduction claimed under chapter VIA [Sec. 80-IA

to Sec. 80RRB (except Sec. 80P)], Sec. 10AA and Sec. 35AD after allowing depreciation on assets for which deduction u/s 35AD was claimed.

AMT would be computed @ 18.5% on Adjusted Total Income. Surcharge and health & education cess shall be levied, as applicable. AMT shall not be applicable for individuals & HUF opting for new tax regime u/s 115BAC and co-operative societies opting for new tax regime u/s 115BAD. In case of a unit located in an International Financial Services Centre and derives its income solely in convertible foreign exchange, AMT shall be computed @ 9%.

Securities Transaction Tax

STT levied on the value of taxable securities transaction has been kept unchanged:

Sl. No. 1.

Transactions

Purchase/Sale of equity shares(delivery based)

Rate

0.1%

Payable by

Purchaser/Seller

Purchase of units of equity oriented mutual fund(delivery based)

Nil

Sale of units of equity oriented mutual fund(delivery based)

0.001%

Sale of equity shares, units of equity oriented mutual fund(non- delivery based)

0.025%

Sale of an option in securities

0.017%

Sale of an option in securities, where option is exercised

0.125%

Sale of futures in securities

0.01%

Sale of unit of equity oriented fund to mutual fund

0.001%

Sale or surrender or redemption of a unit of an equity oriented fund to an insurance company, on maturity or partial withdrawal, with respect to unit linked insurance policy

0.001%

2. Purchaser

3. Seller

4.

Seller

5. Seller

6. Purchaser

7.

Seller

8. Seller

9.

Seller

122

Building a Resilient and Confident India