Page 126 - DHC Budget Book 2021-22 Final

P. 126

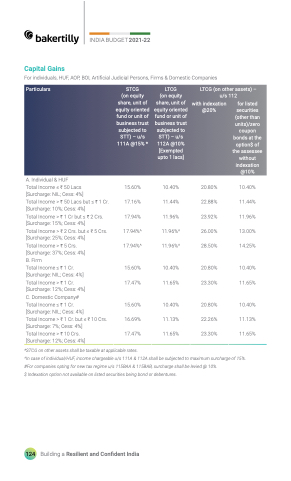

A. Individual & HUF

Total Income ≤ H 50 Lacs

[Surcharge: NIL; Cess: 4%]

Total Income > H 50 Lacs but ≤ H 1 Cr. [Surcharge: 10%; Cess: 4%]

Total Income > H 1 Cr but ≤ H 2 Crs. [Surcharge: 15%; Cess: 4%]

Total Income > H 2 Crs. but ≤ H 5 Crs. [Surcharge: 25%; Cess: 4%]

Total Income > H 5 Crs.

[Surcharge: 37%; Cess: 4%]

B. Firm

Total Income ≤ H 1 Cr.

[Surcharge: NIL; Cess: 4%]

Total Income > H 1 Cr.

[Surcharge: 12%; Cess: 4%]

C. Domestic Company#

Total Income ≤ H 1 Cr.

[Surcharge: NIL; Cess: 4%]

Total Income > H 1 Cr. but ≤ H 10 Crs. [Surcharge: 7%; Cess: 4%]

Total Income > H 10 Crs.

[Surcharge: 12%; Cess: 4%]

10.40%

11.44%

11.96%

13.00%

14.25%

10.40%

11.65%

10.40%

11.13%

11.65%

INDIA BUDGET 2021-22

Capital Gains

For individuals, HUF, AOP, BOI, Artificial Judicial Persons, Firms & Domestic Companies

Particulars

STCG

(on equity share, unit of equity oriented fund or unit of business trust subjected to STT) – u/s 111A @15% *

LTCG

(on equity share, unit of equity oriented fund or unit of business trust subjected to STT) – u/s 112A @10% [Exempted upto 1 lacs]

LTCG (on other assets) – u/s 112

with indexation @20%

for listed securities (other than units)/zero coupon bonds at the option$ of the assessee without indexation @10%

15.60%

10.40%

20.80%

17.16%

11.44%

22.88%

17.94%

11.96%

23.92%

17.94%^

11.96%^

26.00%

17.94%^

11.96%^

28.50%

15.60%

10.40%

20.80%

17.47%

11.65%

23.30%

15.60%

10.40%

20.80%

16.69%

11.13%

22.26%

17.47%

11.65%

23.30%

*STCG on other assets shall be taxable at applicable rates.

^In case of individual/HUF, income chargeable u/s 111A & 112A shall be subjected to maximum surcharge of 15%. #For companies opting for new tax regime u/s 115BAA & 115BAB, surcharge shall be levied @ 10%.

$ Indexation option not available on listed securities being bond or debentures.

124 Building a Resilient and Confident India