Page 42 - Demo

P. 42

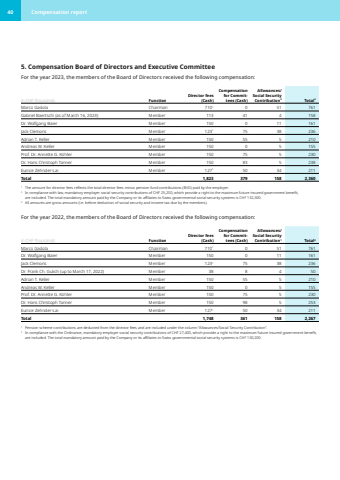

40 Compensation report5. Compensation Board of Directors and Executive CommitteeFor the year 2023, the members of the Board of Directors received the following compensation:in CHF thousands FunctionDirector fees (Cash)Compensation for Committees (Cash)Allowances/ Social Security Contribution2 Total3Marco Gadola Chairman 7101 0 51 761 Gabriel Baertschi (as of March 16, 2023) Member 113 41 4 158 Dr. Wolfgang Baier Member 150 0 11 161 Jack Clemons Member 1231 75 38 236 Adrian T. Keller Member 150 55 5 210 Andreas W. Keller Member 150 0 5 155 Prof. Dr. Annette G. K%u00f6hler Member 150 75 5 230 Dr. Hans Christoph Tanner Member 150 83 5 238 Eunice Zehnder-Lai Member 1271 50 34 211 Total 1,823 379 158 2,360 1 The amount for director fees reflects the total director fees minus pension fund contributions (BVG) paid by the employer. 2 In compliance with law, mandatory employer social security contributions of CHF 25,200, which provide a right to the maximum future insured government benefit, are included. The total mandatory amount paid by the Company or its affiliates to Swiss governmental social security systems is CHF 132,300.3 All amounts are gross amounts (i.e. before deduction of social security and income tax due by the members).For the year 2022, the members of the Board of Directors received the following compensation:in CHF thousands FunctionDirector fees (Cash)Compensation for Committees (Cash)Allowances/ Social Security Contribution1 Total2Marco Gadola Chairman 7101 0 51 761 Dr. Wolfgang Baier Member 150 0 11 161 Jack Clemons Member 1231 75 38 236 Dr. Frank Ch. Gulich (up to March 17, 2022) Member 38 8 4 50 Adrian T. Keller Member 150 55 5 210 Andreas W. Keller Member 150 0 5 155 Prof. Dr. Annette G. K%u00f6hler Member 150 75 5 230 Dr. Hans Christoph Tanner Member 150 98 5 253 Eunice Zehnder-Lai Member 1271 50 34 211 Total 1,748 361 158 2,267 1 Pension scheme contributions are deducted from the director fees and are included under the column %u201cAllowances/Social Security Contribution%u201d.2 In compliance with the Ordinance, mandatory employer social security contributions of CHF 27,400, which provide a right to the maximum future insured government benefit, are included. The total mandatory amount paid by the Company or its affiliates to Swiss governmental social security systems is CHF 130,200.