Page 5 - Yaskawa 2022 Open Enrollment Guide

P. 5

2022 Benefits Guide

Medical and Prescription Drug Plans

Yaskawa America, Inc. will continue to ofer our medical health insurance through UnitedHealthcare. The

program provides eligible Associates access to a national network of healthcare providers who meet

stringent credentialing standards. You will not need a referral from your primary doctor to see a specialist in

the network.

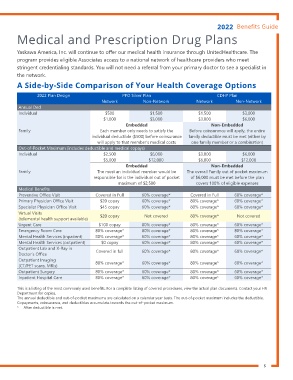

A Side-by-Side Comparison of Your Health Coverage Options

2022 Plan Design PPO Silver Plan CDHP Plan

Network Non-Network Network Non-Network

Annual Ded

Individual $500 $1,500 $1,500 $3,000

$1,000 $3,000 $3,000 $6,000

Embedded Non-Embedded

Family Each member only needs to satisfy the Before coinsurance will apply, the entire

individual deductible ($500) before coinsurance family deductible must be met (either by

will apply to that member’s medical costs one family member or a combination)

Out-of-Pocket Maximum (includes deductible and medical copays)

Individual $2,500 $6,000 $3,000 $6,000

$5,000 $12,000 $6,000 $12,000

Embedded Non-Embedded

Family The most an individual member would be The overall Family out of pocket maximum

responsible for is the individual out of pocket of $6,000 must be met before the plan

maximum of $2,500 covers 100% of eligible expenses

Medical Beneits

Preventive Oice Visit Covered in Full 60% coverage* Covered in Full 60% coverage*

Primary Physician Oice Visit $20 copay 60% coverage* 80% coverage* 60% coverage*

Specialist Physician Oice Visit $45 copay 60% coverage* 80% coverage* 60% coverage*

Virtual Visits $20 copay Not covered 80% coverage* Not covered

(telemental health support available)

Urgent Care $100 copay 80% coverage* 80% coverage* 60% coverage*

Emergency Room Care 80% coverage* 80% coverage* 80% coverage* 80% coverage*

Mental Health Services (inpatient) 80% coverage* 60% coverage* 80% coverage* 60% coverage*

Mental Health Services (outpatient) $0 copay 60% coverage* 80% coverage* 60% coverage*

Outpatient Lab and X-Ray in Covered in full 60% coverage* 80% coverage* 60% coverage*

Doctor’s Oice

Outpatient Imaging 80% coverage* 60% coverage* 80% coverage* 60% coverage*

(CT/PET scans, MRIs)

Outpatient Surgery 80% coverage* 60% coverage* 80% coverage* 60% coverage*

Inpatient Hospital Care 80% coverage* 60% coverage* 80% coverage* 60% coverage*

This is a listing of the most commonly used beneits. For a complete listing of covered procedures, view the actual plan documents. Contact your HR

Department for copies.

The annual deductible and out-of-pocket maximums are calculated on a calendar year basis. The out-of-pocket maximum includes the deductible.

Copayments, coinsurance, and deductibles accumulate towards the out-of-pocket maximum.

* After deductible is met.

5

Medical and Prescription Drug Plans

Yaskawa America, Inc. will continue to ofer our medical health insurance through UnitedHealthcare. The

program provides eligible Associates access to a national network of healthcare providers who meet

stringent credentialing standards. You will not need a referral from your primary doctor to see a specialist in

the network.

A Side-by-Side Comparison of Your Health Coverage Options

2022 Plan Design PPO Silver Plan CDHP Plan

Network Non-Network Network Non-Network

Annual Ded

Individual $500 $1,500 $1,500 $3,000

$1,000 $3,000 $3,000 $6,000

Embedded Non-Embedded

Family Each member only needs to satisfy the Before coinsurance will apply, the entire

individual deductible ($500) before coinsurance family deductible must be met (either by

will apply to that member’s medical costs one family member or a combination)

Out-of-Pocket Maximum (includes deductible and medical copays)

Individual $2,500 $6,000 $3,000 $6,000

$5,000 $12,000 $6,000 $12,000

Embedded Non-Embedded

Family The most an individual member would be The overall Family out of pocket maximum

responsible for is the individual out of pocket of $6,000 must be met before the plan

maximum of $2,500 covers 100% of eligible expenses

Medical Beneits

Preventive Oice Visit Covered in Full 60% coverage* Covered in Full 60% coverage*

Primary Physician Oice Visit $20 copay 60% coverage* 80% coverage* 60% coverage*

Specialist Physician Oice Visit $45 copay 60% coverage* 80% coverage* 60% coverage*

Virtual Visits $20 copay Not covered 80% coverage* Not covered

(telemental health support available)

Urgent Care $100 copay 80% coverage* 80% coverage* 60% coverage*

Emergency Room Care 80% coverage* 80% coverage* 80% coverage* 80% coverage*

Mental Health Services (inpatient) 80% coverage* 60% coverage* 80% coverage* 60% coverage*

Mental Health Services (outpatient) $0 copay 60% coverage* 80% coverage* 60% coverage*

Outpatient Lab and X-Ray in Covered in full 60% coverage* 80% coverage* 60% coverage*

Doctor’s Oice

Outpatient Imaging 80% coverage* 60% coverage* 80% coverage* 60% coverage*

(CT/PET scans, MRIs)

Outpatient Surgery 80% coverage* 60% coverage* 80% coverage* 60% coverage*

Inpatient Hospital Care 80% coverage* 60% coverage* 80% coverage* 60% coverage*

This is a listing of the most commonly used beneits. For a complete listing of covered procedures, view the actual plan documents. Contact your HR

Department for copies.

The annual deductible and out-of-pocket maximums are calculated on a calendar year basis. The out-of-pocket maximum includes the deductible.

Copayments, coinsurance, and deductibles accumulate towards the out-of-pocket maximum.

* After deductible is met.

5