Page 26 - Healthcare PE Pitchbook 34210

P. 26

Case study

Case study

Healthcare group with 5,000 employees uses Conjoint

calculator to align reward cost with employee perceived value

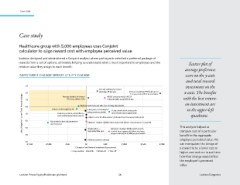

Lockton designed and administered a Conjoint analysis where participants selected a preferred package of

rewards from a set of options, ultimately helping us understand what is most important to employees and the Scatter plot of

U:\STLShared\MDS\2-Internal\EB\COMPRAC\ relative value they assign to each beneit.

Marketing\2020 Marketing\34253\Source average preference

Files\Investment vs utility INVESTMENT CHANGE VERSUS UTILITY CHANGE score on the y-axis

and total reward

3.0 investment on the

Two (2) additional personal

paid days off per year Increase maximum PTO bank size to x-axis. The beneits

2.0

1.5× your annual PTO accrual value with the best return-

Increase buyback of unused

Utility change from current Total Rewards package -1.0 Skip merit/market adjustments for Replace merit increases with cost-of-living adjustments in the upper-left

403(b) company match of 0.25

PTO from 50% to 75%

cents per dollar up to 6.0% of pay

1.0

on-investment are

0.0

Reduce merit budget by 1%

Lower your cost sharing for

Trade current merit increase for

using premium provider

end-of-year bonus opportunity

Voluntary accident, critical illness,

quadrant.

and hospital indemnity insurance

Adjust cost of health insurance premiums based on annual salary level

-2.0

Eliminate employer 403(b) match and permit rollover of your balance to your IRA

one fiscal year

-3.0

compare cost of a particular

high deductible plan

student loan repayment/tuition assistance

program with up to $1,000 per year benefit

-4.0 Single option — Eliminate employer 403(b) match, launch This analysis helped us

beneit to the aggregate

Eliminate spousal coverage employee perceived value. We

-5.0

-$1,500 -$1,000 -$500 $0 $500 $1,000 $1,500 $2,000 can manipulate the design of

Change in Total Rewards investment $ (per person) a reward to be a lower cost or

Compensation Benefits Retirement Time off

higher cost and see in real time

how that change would affect

the employee’s perceived

value.

Lockton Private Equity/Healthcare pitchbook 26 Lockton Companies

Case study

Healthcare group with 5,000 employees uses Conjoint

calculator to align reward cost with employee perceived value

Lockton designed and administered a Conjoint analysis where participants selected a preferred package of

rewards from a set of options, ultimately helping us understand what is most important to employees and the Scatter plot of

U:\STLShared\MDS\2-Internal\EB\COMPRAC\ relative value they assign to each beneit.

Marketing\2020 Marketing\34253\Source average preference

Files\Investment vs utility INVESTMENT CHANGE VERSUS UTILITY CHANGE score on the y-axis

and total reward

3.0 investment on the

Two (2) additional personal

paid days off per year Increase maximum PTO bank size to x-axis. The beneits

2.0

1.5× your annual PTO accrual value with the best return-

Increase buyback of unused

Utility change from current Total Rewards package -1.0 Skip merit/market adjustments for Replace merit increases with cost-of-living adjustments in the upper-left

403(b) company match of 0.25

PTO from 50% to 75%

cents per dollar up to 6.0% of pay

1.0

on-investment are

0.0

Reduce merit budget by 1%

Lower your cost sharing for

Trade current merit increase for

using premium provider

end-of-year bonus opportunity

Voluntary accident, critical illness,

quadrant.

and hospital indemnity insurance

Adjust cost of health insurance premiums based on annual salary level

-2.0

Eliminate employer 403(b) match and permit rollover of your balance to your IRA

one fiscal year

-3.0

compare cost of a particular

high deductible plan

student loan repayment/tuition assistance

program with up to $1,000 per year benefit

-4.0 Single option — Eliminate employer 403(b) match, launch This analysis helped us

beneit to the aggregate

Eliminate spousal coverage employee perceived value. We

-5.0

-$1,500 -$1,000 -$500 $0 $500 $1,000 $1,500 $2,000 can manipulate the design of

Change in Total Rewards investment $ (per person) a reward to be a lower cost or

Compensation Benefits Retirement Time off

higher cost and see in real time

how that change would affect

the employee’s perceived

value.

Lockton Private Equity/Healthcare pitchbook 26 Lockton Companies