Page 37 - IVX Health

P. 37

Mergers and Acquisitions

Mergers and acquisitions

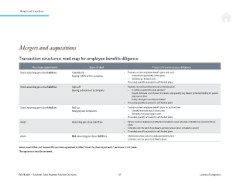

Transaction structures: road map for employee beneits diligence

Purchase agreement Type of deal Focus of insurance due diligence

Stock assuming pre-close liabilities Standalone • Evaluate current employee beneit plans and costs

Buying 100% of the company − Evaluate the portability of the plans

− Estimate go-forward costs

• If needed, quantify accruals for self-funded plans

Stock assuming pre-close liabilities Spin-off • Evaluate current beneit plans and costs/allocation

Buying a division of a company − Is entity or parent the plan sponsor?

− Parent: Estimate cost of plans for NewCo and quantify any NewCo potential liability for parent

plans post-close

− Entity: Change in control provisions?

• If needed, quantify accruals for self-funded plans

Stock assuming pre-close liabilities Roll-up • Evaluate current employee beneit plans for both entities

Merging two companies − Identify/estimate stand-alone costs

− Estimate merged program costs

• If needed, quantify accruals for self-funded plans

Asset Assuming pre-close liabilities • Ensure current employee beneit plans included in asset schedule or NewCo has access to these

plans

• Estimate costs for post-close NewCo policies (unless plans included in assets)

• If needed, quantify accruals for self-funded plans

Asset Not assuming pre-close liabilities • Identify pre-close costs for employee beneit plans

• Estimate costs for post-close NewCo plans

Never assume that just because the purchase agreement is titled “Asset Purchase Agreement,” purchaser is not liable.

The agreement must be reviewed.

IVX Health — Lockton Total Rewards Practice Overview 37 Lockton Companies

Mergers and acquisitions

Transaction structures: road map for employee beneits diligence

Purchase agreement Type of deal Focus of insurance due diligence

Stock assuming pre-close liabilities Standalone • Evaluate current employee beneit plans and costs

Buying 100% of the company − Evaluate the portability of the plans

− Estimate go-forward costs

• If needed, quantify accruals for self-funded plans

Stock assuming pre-close liabilities Spin-off • Evaluate current beneit plans and costs/allocation

Buying a division of a company − Is entity or parent the plan sponsor?

− Parent: Estimate cost of plans for NewCo and quantify any NewCo potential liability for parent

plans post-close

− Entity: Change in control provisions?

• If needed, quantify accruals for self-funded plans

Stock assuming pre-close liabilities Roll-up • Evaluate current employee beneit plans for both entities

Merging two companies − Identify/estimate stand-alone costs

− Estimate merged program costs

• If needed, quantify accruals for self-funded plans

Asset Assuming pre-close liabilities • Ensure current employee beneit plans included in asset schedule or NewCo has access to these

plans

• Estimate costs for post-close NewCo policies (unless plans included in assets)

• If needed, quantify accruals for self-funded plans

Asset Not assuming pre-close liabilities • Identify pre-close costs for employee beneit plans

• Estimate costs for post-close NewCo plans

Never assume that just because the purchase agreement is titled “Asset Purchase Agreement,” purchaser is not liable.

The agreement must be reviewed.

IVX Health — Lockton Total Rewards Practice Overview 37 Lockton Companies