Page 13 - 2017 Benefits Enrollment

P. 13

Lanter Delivery Systems, Inc.

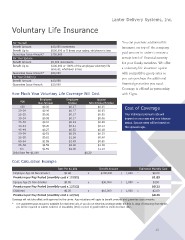

Voluntary Life Insurance

For Yourself You can purchase additional life

Beneit Amount $10,000 increments insurance on top of the company

Beneit Up to $500,000 or 5 times your salary, whichever is less paid amount in order to ensure a

Guarantee Issue Amount* $150,000

For Your Spouse certain level of inancial security

Beneit Amount $5,000 increments for your family members. We offer

Beneit Up to $200,000 or 100% of the employee voluntary life

amount, whichever is less a voluntary life insurance option

Guarantee Issue Amount* $30,000 with competitive group rates so

For Your Child(ren) you can purchase the additional

Beneit Amount $10,000

Guarantee Issue Amount $10,000 inancial protection you need.

Coverage is offered in partnership

How Much Your Voluntary Life Coverage Will Cost with Cigna.

Age Employee Employee Spouse

Non-Smoker Smoker Non-Smoker/Smoker

<20 $0.06 $0.17 $0.05 Cost of Coverage

20–24 $0.06 $0.17 $0.05

25–29 $0.06 $0.17 $0.05 Your individual premium rate will

30–34 $0.08 $0.17 $0.06 depend on your age and your tobacco

35–39 $0.10 $0.23 $0.08 status. Spouse rates will be based on

40–44 $0.20 $0.41 $0.13 the spouse’s age.

45–49 $0.27 $0.53 $0.18

50–54 $0.52 $0.93 $0.29

55–59 $0.82 $1.38 $0.40

60–64 $1.55 $2.49 $0.65

65–69 $2.59 $4.00 $1.18

70+ $2.59 $4.00 $1.19

Child Rate Per $1,000 $0.20

Cost Calculation Example

Rate Per $1,000 Beneit Amount Estimated Monthly Cost

Employee Age 33 Non-Smoker $0.08 x $100,000 / 1,000 = $8.00

Premium per Pay Period (monthly cost x 12/52) $1.85

Spouse Age 29 Non-Smoker $0.05 x $30,000 / 1,000 = $150

Premium per Pay Period (monthly cost x 12/52) $0.35

Child(ren) $0.20 x $10,000 / 1,000 = $2.00

Premium per Pay Period (monthly cost x 12/52) $0.46

Coverage will not take effect until approved by the carrier. Age reductions will apply to beneit amounts and guarantee issue amounts.

* The guarantee issue amount is available for new hires only. If you do not elect this coverage within the irst 31 days of becoming irst eligible,

you will be required to submit evidence of insurability (EOI) or proof of good health to enroll at a later date.

13

Voluntary Life Insurance

For Yourself You can purchase additional life

Beneit Amount $10,000 increments insurance on top of the company

Beneit Up to $500,000 or 5 times your salary, whichever is less paid amount in order to ensure a

Guarantee Issue Amount* $150,000

For Your Spouse certain level of inancial security

Beneit Amount $5,000 increments for your family members. We offer

Beneit Up to $200,000 or 100% of the employee voluntary life

amount, whichever is less a voluntary life insurance option

Guarantee Issue Amount* $30,000 with competitive group rates so

For Your Child(ren) you can purchase the additional

Beneit Amount $10,000

Guarantee Issue Amount $10,000 inancial protection you need.

Coverage is offered in partnership

How Much Your Voluntary Life Coverage Will Cost with Cigna.

Age Employee Employee Spouse

Non-Smoker Smoker Non-Smoker/Smoker

<20 $0.06 $0.17 $0.05 Cost of Coverage

20–24 $0.06 $0.17 $0.05

25–29 $0.06 $0.17 $0.05 Your individual premium rate will

30–34 $0.08 $0.17 $0.06 depend on your age and your tobacco

35–39 $0.10 $0.23 $0.08 status. Spouse rates will be based on

40–44 $0.20 $0.41 $0.13 the spouse’s age.

45–49 $0.27 $0.53 $0.18

50–54 $0.52 $0.93 $0.29

55–59 $0.82 $1.38 $0.40

60–64 $1.55 $2.49 $0.65

65–69 $2.59 $4.00 $1.18

70+ $2.59 $4.00 $1.19

Child Rate Per $1,000 $0.20

Cost Calculation Example

Rate Per $1,000 Beneit Amount Estimated Monthly Cost

Employee Age 33 Non-Smoker $0.08 x $100,000 / 1,000 = $8.00

Premium per Pay Period (monthly cost x 12/52) $1.85

Spouse Age 29 Non-Smoker $0.05 x $30,000 / 1,000 = $150

Premium per Pay Period (monthly cost x 12/52) $0.35

Child(ren) $0.20 x $10,000 / 1,000 = $2.00

Premium per Pay Period (monthly cost x 12/52) $0.46

Coverage will not take effect until approved by the carrier. Age reductions will apply to beneit amounts and guarantee issue amounts.

* The guarantee issue amount is available for new hires only. If you do not elect this coverage within the irst 31 days of becoming irst eligible,

you will be required to submit evidence of insurability (EOI) or proof of good health to enroll at a later date.

13