Page 250 - SALIK PR REPORT AUGUST 2024

P. 250

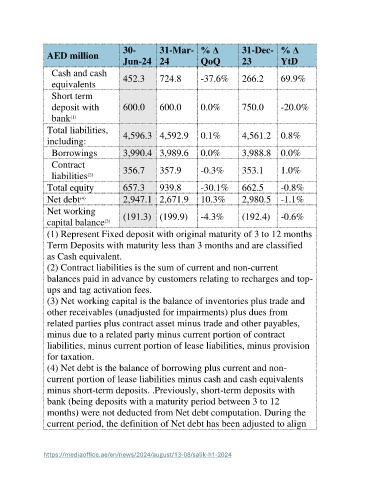

30- 31-Mar- % Δ 31-Dec- % Δ

AED million

Jun-24 24 QoQ 23 YtD

Cash and cash 452.3 724.8 -37.6% 266.2 69.9%

equivalents

Short term

deposit with 600.0 600.0 0.0% 750.0 -20.0%

bank

(1)

Total liabilities, 4,596.3 4,592.9 0.1% 4,561.2 0.8%

including:

Borrowings 3,990.4 3,989.6 0.0% 3,988.8 0.0%

Contract 356.7 357.9 -0.3% 353.1 1.0%

liabilities

(2)

Total equity 657.3 939.8 -30.1% 662.5 -0.8%

Net debt 2,947.1 2,671.9 10.3% 2,980.5 -1.1%

(4)

Net working

capital balance (191.3) (199.9) -4.3% (192.4) -0.6%

(3)

(1) Represent Fixed deposit with original maturity of 3 to 12 months

Term Deposits with maturity less than 3 months and are classified

as Cash equivalent.

(2) Contract liabilities is the sum of current and non-current

balances paid in advance by customers relating to recharges and top-

ups and tag activation fees.

(3) Net working capital is the balance of inventories plus trade and

other receivables (unadjusted for impairments) plus dues from

related parties plus contract asset minus trade and other payables,

minus due to a related party minus current portion of contract

liabilities, minus current portion of lease liabilities, minus provision

for taxation.

(4) Net debt is the balance of borrowing plus current and non-

current portion of lease liabilities minus cash and cash equivalents

minus short-term deposits. .Previously, short-term deposits with

bank (being deposits with a maturity period between 3 to 12

months) were not deducted from Net debt computation. During the

current period, the definition of Net debt has been adjusted to align

https://mediaoffice.ae/en/news/2024/august/13-08/salik-h1-2024