Page 251 - SALIK PR REPORT AUGUST 2024

P. 251

30- 31-Mar- % Δ 31-Dec- % Δ

AED million

Jun-24 24 QoQ 23 YtD

it as per the debt agreement with the bank and accordingly,

historical reported amounts for Net debt have been updated to

reflect the same change in definition.

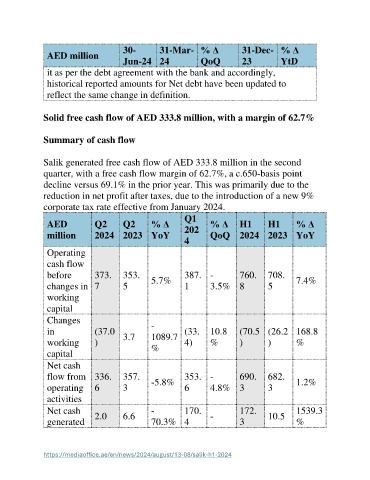

Solid free cash flow of AED 333.8 million, with a margin of 62.7%

Summary of cash flow

Salik generated free cash flow of AED 333.8 million in the second

quarter, with a free cash flow margin of 62.7%, a c.650-basis point

decline versus 69.1% in the prior year. This was primarily due to the

reduction in net profit after taxes, due to the introduction of a new 9%

corporate tax rate effective from January 2024.

Q1

AED Q2 Q2 % Δ 202 % Δ H1 H1 % Δ

million 2024 2023 YoY QoQ 2024 2023 YoY

4

Operating

cash flow

before 373. 353. 5.7% 387. - 760. 708. 7.4%

changes in 7 5 1 3.5% 8 5

working

capital

Changes

in (37.0 3.7 - (33. 10.8 (70.5 (26.2 168.8

1089.7

working ) 4) % ) ) %

capital %

Net cash

flow from 336. 357. 353. - 690. 682.

operating 6 3 -5.8% 6 4.8% 3 3 1.2%

activities

Net cash 2.0 6.6 - 170. - 172. 10.5 1539.3

generated 70.3% 4 3 %

https://mediaoffice.ae/en/news/2024/august/13-08/salik-h1-2024