Page 17 - The Final W book

P. 17

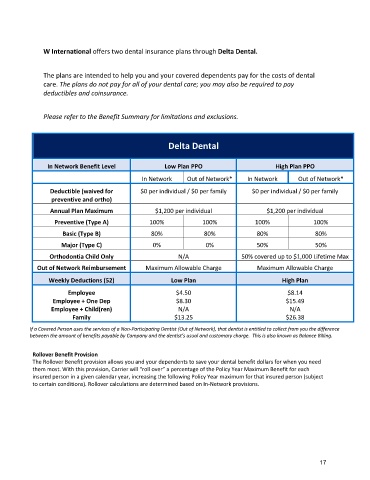

W International offers two dental insurance plans through Delta Dental.

The plans are intended to help you and your covered dependents pay for the costs of dental

care. The plans do not pay for all of your dental care; you may also be required to pay

deductibles and coinsurance.

Please refer to the Benefit Summary for limitations and exclusions.

Delta Dental

In Network Benefit Level Low Plan PPO High Plan PPO

In Network Out of Network* In Network Out of Network*

Deductible (waived for $0 per individual / $0 per family $0 per individual / $0 per family

preventive and ortho)

Annual Plan Maximum $1,200 per individual $1,200 per individual

Preventive (Type A) 100% 100% 100% 100%

Basic (Type B) 80% 80% 80% 80%

Major (Type C) 0% 0% 50% 50%

Orthodontia Child Only N/A 50% covered up to $1,000 Lifetime Max

Out of Network Reimbursement Maximum Allowable Charge Maximum Allowable Charge

Weekly Deductions (52) Low Plan High Plan

Employee $4.50 $8.14

Employee + One Dep $8.30 $15.49

Employee + Child(ren) N/A N/A

Family $13.25 $26.38

If a Covered Person uses the services of a Non-Participating Dentist (Out of Network), that dentist is entitled to collect from you the difference

between the amount of benefits payable by Company and the dentist’s usual and customary charge. This is also known as Balance Billing.

Rollover Benefit Provision

The Rollover Benefit provision allows you and your dependents to save your dental benefit dollars for when you need

them most. With this provision, Carrier will “roll over” a percentage of the Policy Year Maximum Benefit for each

insured person in a given calendar year, increasing the following Policy Year maximum for that insured person (subject

to certain conditions). Rollover calculations are determined based on In-Network provisions.

17