Page 110 - Caribbean-Central America Profile 2018

P. 110

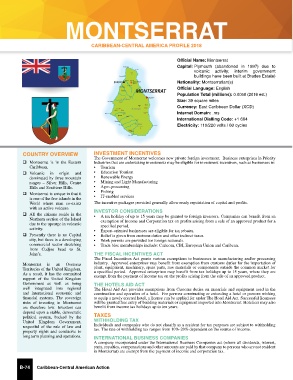

MONTSERRAT

CARIBBEAN-CENTRAL AMERICA PROFILE 2018

Official Name: Montserrat

Capital: Plymouth (abandoned in 1997) due to

volcanic activity; interim government

buildings have been built at Brades Estate)

BRADES Nationality: Montserratian(s)

MONTSERRAT Official Language: English

Population Total (millions): 0.0050 (2016 est.)

Size: 39 square miles

Currency: East Caribbean Dollar (XCD)

Internet Domain: .ms

International Dialling Code: +1 664

Electricity: 110/220 volts / 60 cycles

COUNTRY OVERVIEW INVESTMENT INCENTIVES

The Government of Montserrat welcomes new private foreign investment. Business enterprises in Priority

q Montserrat is in the Eastern Industries that are undertaking investments may be eligible for investment incentives, such as businesses in:

Caribbean. • Tourism

q Volcanic in origin and • Education Tourism

dominated by three mountain • Renewable Energy

ranges – Silver Hills, Centre • Mining and Light Manufacturing

Hills and Soufriere Hills. • Agro-processing

q Montserrat is unique in that it • Fishing

• IT-enabled services

is one of the few islands in the

World where man co-exists The incentive packages provided generally allow ready repatriation of capital and profits.

with an active volcano.

q All the citizens reside in the INVESTOR CONSIDERATIONS

• A tax holiday of up to 15 years may be granted to foreign investors. Companies can benefit from an

Northern section of the Island exemption of Income and Corporation tax on profits arising from a sale of an approved product for a

due to the upsurge in volcanic specified period.

activity. • Export-oriented businesses are eligible for tax rebates.

q Presently there is no Capital • Relief is given from customs duties and other indirect taxes.

city, but there is a developing • Work permits are provided for foreign nationals.

commercial sector stretching • Trade bloc memberships include: Caricom, CBI, European Union and Caribcan.

from Cudjoe head to St.

John’s. THE FISCAL INCENTIVES ACT

The Fiscal Incentives Act grants various exemptions to businesses in manufacturing and/or processing

Montserrat is an Overseas industry. Approved enterprises may benefit from exemption from customs duties for the importation of

Territories of the United Kingdom. plant, equipment, machinery, spare parts, raw materials or components outside the common market for

a specified period. Approved enterprises may benefit from tax holidays up to 15 years, where they are

As a result, it has the committed exempt from the payment of income tax on the profits arising from the sale of an approved product.

support of the United Kingdom

Government as well as being THE HOTELS AID ACT

well integrated into regional The Hotel Aid Act provides exemptions from Customs duties on materials and equipment used in the

and international economic and construction and operation of a hotel. For persons constructing or extending a hotel or persons wishing

financial systems. The sovereign to equip a newly erected hotel, a license can be applied for under The Hotel Aid Act. Successful licensees

risks of investing in Montserrat will be granted free entry of building materials or equipment imported into Montserrat. Hoteliers may also

are therefore low. Investors can benefit from income tax holidays up to ten years.

depend upon a stable, democratic

political system, backed by the TAXES

United Kingdom Government, WITHHOLDING TAX

respectful of the rule of law and Individuals and companies who do not classify as a resident for tax purposes are subject to withholding

tax. The rate of withholding tax ranges from 10%-20% dependent on the source of income.

property rights and conducive to

long term planning and operations. INTERNATIONAL BUSINESS COMPANIES

A company incorporated under the International Business Companies act (where all dividends, interest,

rents, royalties, compensations and other amounts are paid by that company to persons who are not resident

in Montserrat) are exempt from the payment of income and corporation tax.

B-74 Caribbean-Central American Action