Page 29 - Bulletin Vol 29 No 1 - Jan. - Apr. 2024 IN PROGRESS2

P. 29

News |

Finance Article|Foreign Stocks: Do They Still Make Sense?

By Chris Congema, CFP

The importance of diversification has been well established across the investment research literature over

many decades. It is a relatively easy principle for most investors to accept. The words “don’t keep all of

your eggs in one basket” is one of the most common phrases repeated over time.

However, asset allocation is just as important. The concept of asset allocation is based on the notion that

not only do you not want to own just a few companies, but you also want to own assets that demonstrate

a lower correlation to each other. A lower correlation simply means that multiple assets may increase

over time, but at different times, for different reasons, in different environments.

As an example, the use of owning stocks across various market capitalizations, (Large, Mid & Small Cap

stocks), and different regions of the world help diversify a portfolio. Additionally, the use of other assets

such as fixed income, real estate, and commodities further lower correlations in an investment portfolio.

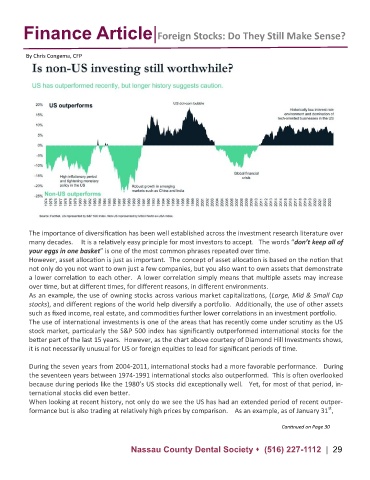

The use of international investments is one of the areas that has recently come under scrutiny as the US

stock market, particularly the S&P 500 index has significantly outperformed international stocks for the

better part of the last 15 years. However, as the chart above courtesy of Diamond Hill Investments shows,

it is not necessarily unusual for US or foreign equities to lead for significant periods of time.

During the seven years from 2004-2011, international stocks had a more favorable performance. During

the seventeen years between 1974-1991 international stocks also outperformed. This is often overlooked

because during periods like the 1980’s US stocks did exceptionally well. Yet, for most of that period, in-

ternational stocks did even better.

When looking at recent history, not only do we see the US has had an extended period of recent outper-

st

formance but is also trading at relatively high prices by comparison. As an example, as of January 31 ,

Continued on Page 30

Nassau County Dental Society ⬧ (516) 227-1112 | 29