Page 9 - Millfield Foundation - Legacy

P. 9

TAX-EFFICIENT GIVING

The Millfield Foundation is a registered leaving 10% or more of their taxable estate

charity (charity number 1121630) and to charity may qualify for a reduced rate of

accordingly all legacies made to the Millfield inheritance tax from 40% to 36%.

Foundation are currently exempt from UK

Inheritance and Capital Gains Taxes. Capital gains tax:

This type of tax is usually payable if you sell

Inheritance Tax: or give away something that has increased

Under current law, if your estate is worth in value during the time you owned it. The

more than £325,000, your beneficiaries will increase in value is what is taxable. When

have to pay 40% of the part of it that’s over someone dies the value of the assets they

the threshold to HMRC. So, if your estate is own is re-established and any gains that arise

worth £500,000, £175,000 of it is liable for during the administration of the estate (i.e.

inheritance tax, and your beneficiaries must between death and sale) may be liable to

pay £70,000 (40% of £175,000) to HMRC. capital gains tax.

What if you leave money to charity?: Charities are exempt from capital gains tax,

There are two ways leaving a gift to charity so where charities are beneficiaries in a Will,

can help reduce your inheritance tax bill. it may be possible to use this exemption to

benefit the whole estate. Please contact your

If you leave gifts to charity in your Will, solicitor to discuss this further.

the gift value won’t be counted towards

inheritance tax, this could therefor reduce By way of example, if a UK testator has an

the amount your beneficiaries have to pay estate of £500,000, a donation of £17,500

or remove your inheritance tax liability would only diminishes the remaining estate

altogether. by £4,200.*

In April 2012, inheritance tax legislation

changed, meaning in some situations, anyone

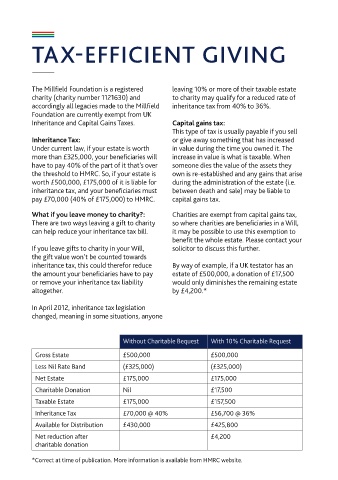

Without Charitable Bequest With 10% Charitable Request

Gross Estate £500,000 £500,000

Less Nil Rate Band (£325,000) (£325,000)

Net Estate £175,000 £175,000

Charitable Donation Nil £17,500

Taxable Estate £175,000 £157,500

Inheritance Tax £70,000 @ 40% £56,700 @ 36%

Available for Distribution £430,000 £425,800

Net reduction after £4,200

charitable donation

*Correct at time of publication. More information is available from HMRC website.