Page 120 - W01TB8_2017-18_[low-res]_F2F_Neat

P. 120

8/4 W01/March 2017 Award in General Insurance

A2C Common subject-matter

For contribution to apply, each insurer must provide cover in respect of the subject-matter of insurance

which suffers loss or damage. This is frequently some form of property, but could equally apply to a legal

liability.

B Application of the principle of contribution

We have seen that insurers contribute to a claim on the basis of what is termed a rateable proportion.

Insurers contribute to

a claim on basis of

rateable proportion

B1 Rateable proportion

Rateable proportion is the share of any claim that an insurer pays when two or more cover the same risk;

usually in proportion to the respective sums insured. We are going to look at two possible ways of

determining the rateable proportion of a claim, namely:

• by sum insured; and

• by independent liability.

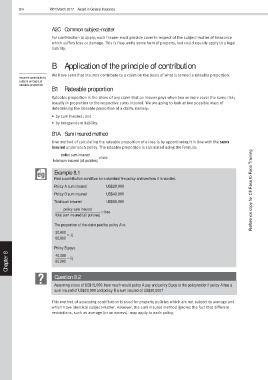

B1A Sum insured method

One method of calculating the rateable proportion of a loss is by apportioning it in line with the sums

insured under each policy. The rateable proportion is calculated using the formula:

policy sum insured × loss

total sum insured (all policies)

Example 8.1

Find a contribution condition on a standard fire policy and see how it is worded.

Policy A sum insured US$20,000

Policy B sum insured US$40,000 Reference copy for CII Face to Face Training

Total sum insured US$60,000

policy sum insured ×

total sum insured (all policies) loss

The proportion of the claim paid by policy A is:

20,000

= 1 3

60,000

Policy B pays:

8 40,000 = 2

Chapter 60,000 3

Question 8.2

Assuming a loss of US$15,000, how much would policy A pay and policy B pay to the policyholder if policy A has a

sum insured of US$20,000 and policy B a sum insured of US$30,000?

This method of assessing contribution is used for property policies which are not subject to average and

which have identical subject-matter. However, the sum insured method ignores the fact that different

restrictions, such as average (or an excess), may apply to each policy.