Page 17 - W01TB8_2017-18_[low-res]_F2F_Neat

P. 17

15

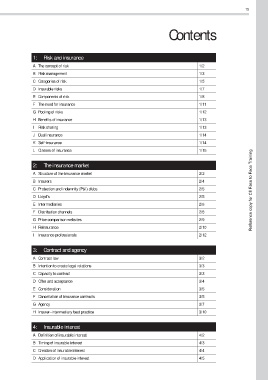

Contents

1: Risk and insurance

A The concept of risk 1/2

B Risk management 1/3

C Categories of risk 1/5

D Insurable risks 1/7

E Components of risk 1/8

F The need for insurance 1/11

G Pooling of risks 1/12

H Benefits of insurance 1/13

I Risk sharing 1/13

J Dual insurance 1/14

K Self-insurance 1/14

L Classes of insurance 1/15

2: The insurance market

A Structure of the insurance market 2/2

B Insurers 2/4

C Protection and indemnity (P&I) clubs 2/5 Reference copy for CII Face to Face Training

DLloyd’s 2/5

E Intermediaries 2/6

F Distribution channels 2/8

G Price comparison websites 2/9

H Reinsurance 2/10

I Insurance professionals 2/12

3: Contract and agency

A Contract law 3/2

B Intention to create legal relations 3/3

C Capacity to contract 3/3

D Offer and acceptance 3/4

E Consideration 3/5

F Cancellation of insurance contracts 3/5

GAgency 3/7

H Insurer–intermediary best practice 3/10

4: Insurable interest

A Definition of insurable interest 4/2

B Timing of insurable interest 4/3

C Creation of insurable interest 4/4

D Application of insurable interest 4/5