Page 183 - W01TB8_2017-18_[low-res]_F2F_Neat

P. 183

Self-test answers ix

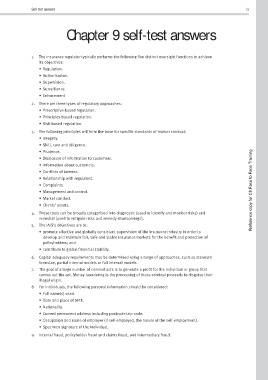

Chapter 9 self-test answers

1. The insurance regulator typically performs the following five distinct oversight functions to achieve

its objectives:

• Regulation.

• Authorisation.

• Supervision.

• Surveillance.

• Enforcement

2. There are three types of regulatory approaches:

• Prescriptive-based regulation.

• Principles-based regulation.

• Risk-based regulation.

3. The following principles will form the base for specific standards of market conduct:

• Integrity.

• Skill, care and diligence.

• Prudence.

• Disclosure of information to customers.

• Information about customers.

• Conflicts of interest.

• Relationship with regulators.

• Complaints.

• Management and control. Reference copy for CII Face to Face Training

• Market conduct.

• Clients’ assets.

4. These tools can be broadly categorised into diagnostic (used to identify and monitor risks) and

remedial (used to mitigate risks and remedy shortcomings).

5. The IAIS’s objectives are to:

• promote effective and globally consistent supervision of the insurance industry in order to

develop and maintain fair, safe and stable insurance markets for the benefit and protection of

policyholders; and

• contribute to global financial stability.

6. Capital adequacy requirements may be determined using a range of approaches, such as standard

formulae, partial internal models or full internal models.

7. The goal of a large number of criminal acts is to generate a profit for the individual or group that

carries out the act. Money laundering is the processing of these criminal proceeds to disguise their

illegal origin.

8. For individuals, the following personal information should be considered:

• Full name(s) used.

• Date and place of birth.

• Nationality.

• Current permanent address including postcode/zip code.

• Occupation and name of employer (if self-employed, the nature of the self-employment).

• Specimen signature of the individual.

9. Internal fraud, policyholder fraud and claims fraud, and intermediary fraud.