Page 39 - W01TB8_2017-18_[low-res]_F2F_Neat

P. 39

2 Chapter

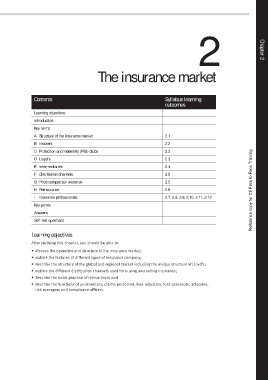

2

The insurance market

Contents Syllabus learning

outcomes

Learning objectives

Introduction

Key terms

A Structure of the insurance market 2.1

B Insurers 2.2

C Protection and indemnity (P&I) clubs 2.3

D Lloyd’s 2.3

E Intermediaries 2.4

F Distribution channels 2.5

G Price comparison websites 2.5

H Reinsurance 2.6 Reference copy for CII Face to Face Training

I Insurance professionals 2.7, 2.8, 2.9, 2.10, 2.11, 2.12

Key points

Answers

Self-test questions

Learning objectives

After studying this chapter, you should be able to:

• discuss the operation and structure of the insurance market;

• outline the features of different types of insurance company;

• describe the structure of the global and regional market including the unique structure of Lloyd’s;

• outline the different distribution channels used for buying and selling insurance;

• describe the basic purpose of reinsurance; and

• describe the functions of underwriters, claims personnel, loss adjusters, loss assessors, actuaries,

risk managers and compliance officers.