Page 46 - W01TB8_2017-18_[low-res]_F2F_Neat

P. 46

2/8 W01/March 2017 Award in General Insurance

What we have considered so far are services provided to clients. Other functions may be carried out by

the intermediary on behalf of insurers, depending upon the Terms of Business Agreement. These could

include:

2 • collecting the premium;

Chapter • committing the insurer to cover the risk (if authorised);

• settling claims on behalf of the insurer (if authorised); and

• issuing motor, or other cover notes to give evidence of cover.

E5 Appointed representatives

If an intermediary operates as an appointed representative of an insurer (known as the principal), they

may only give advice in relation to that insurer’s products. They do not, therefore, carry out the wider

functions that relate to the suitability of different markets, although they continue to have a

responsibility to match a client’s demands and needs with suitable products from the insurer’s

product range.

They may also carry out functions that they are authorised to do by the insurer; this could include

alterations and renewal.

The important thing to note is that the principal takes responsibility for the appointed representative’s

activities and so must have adequate oversight arrangements in place.

F Distribution channels

So far we have considered how the insurance market operates and looked at the components of the

market, i.e. buyers, insurers and intermediaries. In this section, we examine distribution – in other

words the way in which the products are made available to the customer through product marketing.

The distribution channels used for insurance can be divided into two main types: direct and indirect

channels. Reference copy for CII Face to Face Training

• Direct: employees of the insurer sell the insurance products direct to the customer or direct mailing

techniques are used to promote sales.

• Indirect: intermediaries paid by the insurer promote products on the insurer’s behalf.

Consider this…

Think about aspects of product marketing that could be affected by the distribution channel used.

The choice of distribution will influence the type of advertising used, for example, whether it is to be

aimed at intermediaries or the general public. It will also have an impact on costs relating to staff,

premises and IT equipment.

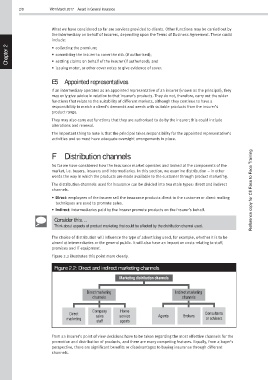

Figure 2.2 illustrates this point more clearly.

Figure 2.2: Direct and indirect marketing channels

Marketing distribution channels

Direct marketing Indirect marketing

channels channels

Company Home

Direct sales service Agents Brokers Consultants

marketing or advisers

staff agents

From an insurer’s point of view decisions have to be taken regarding the most effective channels for the

promotion and distribution of products, and there are many competing features. Equally, from a buyer’s

perspective, there are significant benefits or disadvantages to buying insurance through different

channels.