Page 110 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 110

5/4 M97/February 2018 Reinsurance

Example 5.2

An insurer has a portfolio of 1,000 houses each insured for £400,000. Each house suffered losses of £100,000 in a

windstorm. If the insurer had purchased a 50% quota share treaty it would have reinsured out £50m of the loss but

retained £50m. However, if it had purchased excess of loss cover in a series of layers excess of £10m, up to £100m

it would only retain £10m of the losses. This would make a significant difference to the overall profit account of the

company. Therefore, excess of loss reinsurance minimises the influence of large losses on the insurer’s profits.

Other factors

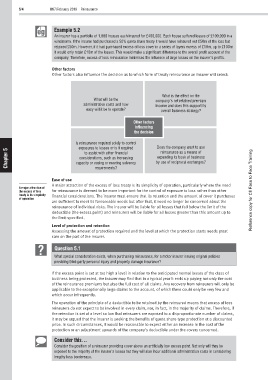

Other factors also influence the decision as to which form of treaty reinsurance an insurer will select:

What is the effect on the

What will be the company’s net retained premium

administrative costs and how income and does this support its

easy will it be to operate? overall business strategy?

Other factors

influencing

the decision

Is reinsurance required solely to control

exposures to losses or is it required Does the company want to use

5 to assist with other financial reinsurance as a means of

Chapter capacity or easing or meeting solvency by use of reciprocal exchanges?

expanding its book of business

considerations, such as increasing

requirements?

Ease of use

A major attraction of the excess of loss treaty is its simplicity of operation, particularly where the need

A major attraction of

the excess of loss for reinsurance is deemed to be more important for the control of exposure to loss rather than other Reference copy for CII Face to Face Training

treaty is its simplicity financial considerations. The insurer must ensure that its retention and the amount of cover it purchases

of operation

are sufficient to meet its foreseeable needs but after that, it need no longer be concerned about the

reinsurance of individual risks. The insurer will be liable for all losses that fall below the limit of the

deductible (the excess point) and reinsurers will be liable for all losses greater than this amount up to

the limit specified.

Level of protection and retention

Assessing the amount of protection required and the level at which the protection starts needs great

care on the part of the insurer.

Question 5.1

What special consideration exists, when purchasing reinsurance, for a motor insurer issuing original policies

providing third-party personal injury and property damage insurance?

If the excess point is set at too high a level in relation to the anticipated normal losses of the class of

business being protected, the insurer may find that in a typical year it ends up paying not only the cost

of the reinsurance premiums but also the full cost of all claims. Any recovery from reinsurers will only be

applicable to the exceptionally large claims to the account, of which there could only be very few and

which occur infrequently.

The operation of the principle of a deductible to be retained by the reinsured means that excess of loss

reinsurers do not expect to be involved in every claim, nor, in fact, in the majority of claims. Therefore, if

the retention is set at a level so low that reinsurers are exposed to a disproportionate number of claims,

it may be argued that the insurer is seeking the benefits of quota share-type protection at a discounted

price. In such circumstances, it would be reasonable to expect either an increase in the cost of the

protection or an adjustment upwards of the company’s deductible under the covers concerned.

Consider this…

Consider the position of a reinsurer providing cover above an artificially low excess point. Not only will they be

exposed to the majority of the insurer’s losses but they will also incur additional administration costs in considering

lengthy loss bordereaux.