Page 125 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 125

Chapter 5 Features and operation of non-proportional reinsurance treaties 5/19

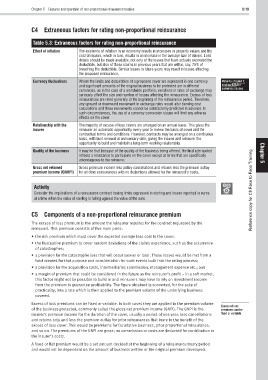

C4 Extraneous factors for rating non-proportional reinsurance

Table 5.3: Extraneous factors for rating non-proportional reinsurance

Effect of inflation The existence of inflation in an economy results in increases in property values and the

cost of repairs, which in turn, results in an increase in the average size of claims. Loss

details should be made available, not only of the losses that have actually exceeded the

deductible, but also of those claims in previous years that are within, say, 75% of

breaching the deductible. Similar losses in future years may result in losses affecting

the proposed reinsurance.

Currency fluctuations Where the limits and deductibles of a proposed cover are expressed in one currency Refer to chapter 7,

and significant amounts of the original business to be protected are in different section B2A for

currency clauses

currencies, as in the case of a worldwide portfolio, variations in rates of exchange may

seriously affect the size and number of losses affecting the reinsurance. Excess of loss

reinsurances are rated generally at the beginning of the reinsurance period. Therefore,

any upward or downward movement in exchange rates would alter burning cost

calculations and these movements cannot be satisfactorily predicted in advance. In

such circumstances, the use of a currency conversion clause will limit any adverse

effects on the cover.

Relationship with the The majority of excess of loss covers are arranged on an annual basis. This gives the

insurer reinsurer an automatic opportunity every year to review the basis of cover and the

contractual terms and conditions. However, contracts may be arranged on a continuous

basis, with tacit renewal at anniversary date, giving the insurer and reinsurer the

opportunity to build and maintain a long-term working relationship.

Quality of the business It may be that because of the quality of the business being offered, the final rate quoted Chapter

reflects a reluctance to participate on the cover except at terms that are specifically

advantageous to the reinsurer. 5

Gross net retained Gross premium income less policy cancellations and returns less the premium outlay

premium income (GNRPI) for all other reinsurances with no deductions allowed for the reinsured’s costs.

Activity

Consider the implications of a reinsurance contract having limits expressed in sterling and losses reported in euros Reference copy for CII Face to Face Training

at a time when the value of sterling is falling against the value of the euro.

C5 Components of a non-proportional reinsurance premium

The excess of loss premium is the amount the reinsurer requires for the contract requested by the

reinsured. This premium consists of five main parts:

• the risk premium which must cover the expected average loss cost to the cover;

• the fluctuation premium to cover random deviations of the claims experience, such as the occurrence

of catastrophes;

• a provision for the catastrophe loss that will occur sooner or later. These losses would be met from a

fund created for that purpose and consideration for such events built into the rating process;

• a provision for the acquisition costs, intermediaries commission, management expense etc.; and

• a margin of premium that could be considered in the future as the reinsurer’s profit – in a soft market,

this factor might not be possible to build in and reinsurers may have to rely on investment income

from the premium to guarantee profitability. The figure obtained is converted, for the sake of

practicality, into a rate which is then applied to the premium volume of the underlying business

covered.

Excess of loss premiums can be fixed or variable. In both cases they are applied to the premium volume

Excess of loss

of the business protected, commonly called the gross net premium income (GNPI). The GNPI is the premiums can be

insurer’s premium income for the duration of the cover, usually a period of one year, less cancellations fixed or variable

and returns only and less the premium outlay for prior reinsurances that inure to the benefit of the

excess of loss cover. This would be premiums for facultative business, prior proportional reinsurance,

and so on. The premiums of the GNPI are gross; no commission or costs are deducted for contribution to

the insurer’s costs.

A fixed or flat premium would be a set amount decided at the beginning of a reinsurance treaty period

and would not be dependent on the amount of business written or the original premium developed.