Page 120 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 120

5/14 M97/February 2018 Reinsurance

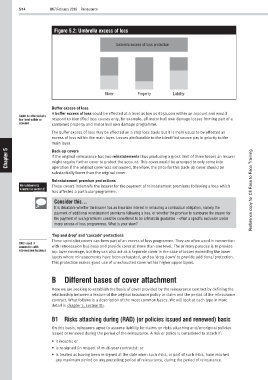

Figure 5.2: Umbrella excess of loss

Umbrella excess of loss protection

Motor Property Liability

Buffer excess of loss

A buffer excess of loss could be effected at a level as low as £250,000 within an account and would

Could be effected at a

low level within an respond to identified loss causes only, for example, all motor hull own damage losses forming part of a

account combined property and motor hull own damage programme.

The buffer excess of loss may be effected on a stop loss basis but it is more usual to be effected as

excess of loss within the main layer. Losses attributable to the identified source pay in priority to the

main layer.

5 Back-up covers

Chapter If the original reinsurance has two reinstatements thus producing a gross limit of three losses an insurer

might require further cover to protect the account. This cover would be arranged to only come into

operation if the original cover was exhausted, therefore, the price for this back-up cover should be

substantially lower than the original cover.

Reinstatement premium protections

Reinstatements These covers indemnify the insurer for the payment of reinstatement premiums following a loss which

covered in section E Reference copy for CII Face to Face Training

has affected a particular programme.

Consider this…

It is debatable whether the insurer has an insurable interest in reinsuring a contractual obligation, namely the

payment of additional reinstatement premiums following a loss, or whether the promise to reimburse the insurer for

the payment of such premiums could be considered to be a financial guarantee – often a specific exclusion under

many excess of loss programmes. What is your view?

‘Top and drop’ and ‘cascade’ protections

These specialist covers can form part of an excess of loss programme. They are often used in connection

Often used in

connection with with retrocession business and provide cover at more than one level. The primary purpose is to provide

retrocession business top layer coverage, but they can also act as a separate cover in the case of losses exceeding the lower

layers where reinstatements have been exhausted, and so ‘drop down’ to provide additional protection.

This protection makes good use of unexhausted cover within higher upper layers.

B Different bases of cover attachment

Here we are seeking to establish the basis of cover provided by the reinsurance contract by defining the

relationship between a feature of the original insurance policy or claim and the period of the reinsurance

contract. What follows is a description of the most common bases. We will look at each type in more

detail in chapter 7, section D1.

B1 Risks attaching during (RAD) (or policies issued and renewed) basis

On this basis, reinsurers agree to assume liability for claims on risks attaching and/or original policies

issued or renewed during the period of the reinsurance. A risk or policy is considered to attach if:

• it incepts; or

• is re-signed (in respect of multi-year contracts); or

• is treated as having been re-signed at the date when such risks, or part of such risks, have reached

any maximum period on any preceding period of reinsurance, during the period of reinsurance.