Page 117 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 117

Chapter 5 Features and operation of non-proportional reinsurance treaties 5/11

Stop loss contract limits are expressed in percentage amounts of the reinsured’s gross net retained

Expressed in

premium income (GNRPI) (for example, 50% GNRPI excess of 105% GNRPI). The GNRPI is the company’s percentage amounts

premium income for the duration of the cover, generally one year, less cancellations and returns only of the reinsured’s

GNRPI

and less the premium outlay for all other reinsurances, as these inure to the benefit of the stop loss

reinsurance.

The premiums of the GNRPI are gross; no commission or costs are deducted for contribution to the

reinsured’s costs. They are subject to minimum and maximum criteria (to protect both parties) and any

resultant recovery converted into monetary terms based upon the ultimate GNRPI for the annual period

in question.

Table 5.1 illustrates three examples of where a reinsurer’s potential liability could attach based on the

reinsuring company’s GNRPI of £1m and the extent of the reinsurer’s liability represented by the

cover range.

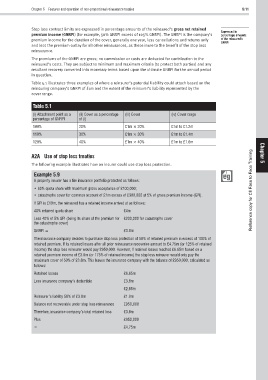

Table 5.1

(i) Attachment point as a (ii) Cover as a percentage (iii) Cover (iv) Cover range

percentage of GNRPI of (i)

100% 20% £1m × 20% £1m to £1.2m

110% 30% £1m × 30% £1m to £1.4m

120% 40% £1m × 40% £1m to £1.6m

A2A Use of stop loss treaties Chapter

The following example illustrates how an insurer could use stop loss protection. 5

Example 5.9

A property insurer has a fire insurance portfolio protected as follows:

• 60% quota share with maximum gross acceptance of £100,000; Reference copy for CII Face to Face Training

• catastrophe cover for common account of £1m excess of £300,000 at 5% of gross premium income (GPI).

If GPI is £10m, the reinsured has a retained income arrived at as follows:

40% retained quota share £4m

Less 40% of 5% GPI (being its share of the premium for £200,000 for catastrophe cover

the catastrophe cover)

GNRPI = £3.8m

The insurance company decides to purchase stop loss protection of 50% of retained premium in excess of 100% of

retained premium. If its retained losses after all prior reinsurance recoveries amount to £4.75m (or 125% of retained

income) the stop loss reinsurer would pay £950,000. However, if retained losses reached £6.65m based on a

retained premium income of £3.8m (or 175% of retained income) the stop loss reinsurer would only pay the

maximum cover of 50% of £3.8m. This leaves the insurance company with the balance of £950,000, calculated as

follows:

Retained losses £6.65m

Less insurance company’s deductible £3.8m

£2.85m

Reinsurer’s liability 50% of £3.8m £1.9m

Balance not recoverable under stop loss reinsurance £950,000

Therefore, insurance company’s total retained loss £3.8m

Plus £950,000

= £4.75m