Page 207 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 207

Chapter 7 Contract wordings 7/45

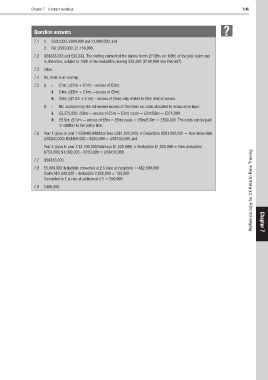

Question answers

7.1 1. £300,000, £800,000 and £1,000,000; and

2. Nil, £600,000, £1,150,000.

7.2 US$333,333 and £33,333. The sterling element of the claims forms 2/12ths (or 1/6th) of the total claim and

is, therefore, subject to 1/6th of the deductible, leaving £33,333 (£100,000 less £66,667).

7.3 False.

7.4 No, there is an overlap.

7.5 A. i. £1m; ((£5m + £1m) – excess of £5m).

ii. £4m; ((£8m + £1m) – excess of £5m).

iii. £5m; ((£10m + £1m) – excess of £5m) only limited to £5m limit of excess.

B. i. Nil; as indemnity did not exceed excess of £5m then no costs allocated to reinsurance layer.

ii. £3,375,000; (£8m -– excess of £5m = £3m) costs = £3m/£8m = £375,000.

iii. £5.5m; (£10m -– excess of £5m = £5m) costs = £5m/£10m = £500,000. The costs can be paid

in addition to the policy limit.

7.6 Year 1 ((loss in year 1 US$400,000/total loss US$1,600,000) × Deductible US$1,000,000 = New deductible

US$250,000) US$400,000 – $250,000 = US$150,000; and

Year 2 ((loss in year 2 $1,200,000/total loss $1,600,000) × Deductible $1,000,000 = New deductible

$750,000) $1,200,000 – $750,000 = US$450,000.

7.7 US$120,000.

7.8 £1,000,000 deductible converted at 2.5 (rate at inception) = A$2,500,000

Claim A$2,600,000 – deductible 2,500,000 = 100,000.

Converted to £ at rate at settlement 2:1 = £50,000.

7.9 £400,000. Reference copy for CII Face to Face Training Chapter

7