Page 214 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 214

8/6 M97/February 2018 Reinsurance

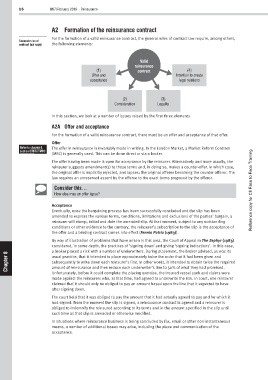

A2 Formation of the reinsurance contract

For the formation of a valid reinsurance contract, the general rules of contract law require, among others,

General rules of

contract law apply the following elements:

Valid

reinsurance

(1) contract (4)

Offer and Intention to create

acceptance legal relations

(2) (3)

Consideration Legality

In this section, we look at a number of issues raised by the first three elements.

A2A Offer and acceptance

For the formation of a valid reinsurance contract, there must be an offer and acceptance of that offer.

Offer

Refer to chapter 6, The offer in reinsurance is invariably made in writing. In the London Market, a Market Reform Contract

section C3B for MRC

(MRC) is generally used. This can be done direct or via a broker.

The offer having been made is open for acceptance by the reinsurer. Alternatively and more usually, the

reinsurer suggests amendment(s) to those terms and, in doing so, makes a counter-offer. In which case,

the original offer is implicitly rejected, and lapses; the original offeree becoming the counter-offeror. The

law requires an unreserved assent by the offeree to the exact terms proposed by the offeror.

Consider this… Reference copy for CII Face to Face Training

How else may an offer lapse?

Acceptance

Eventually, once the bargaining process has been successfully concluded and the slip has been

amended to express the various terms, conditions, limitations and exclusions of the parties’ bargain, a

reinsurer will stamp, initial and date the amended slip. At that moment, subject to any outstanding

conditions or other evidence to the contrary, the reinsurer’s subscription to the slip is the acceptance of

the offer and a binding contract comes into effect (Fennia Patria (1983)).

By way of illustration of problems that have arisen in this area, the Court of Appeal in The Zephyr (1983)

considered, in some depth, the practices of ‘signing down’ and giving ‘signing indications’. In this case,

a broker placed a risk with a number of underwriters. During placement, the broker advised, as was its

8 usual practice, that it intended to place approximately twice the order that it had been given and

Chapter subsequently to write down each reinsurer’s line. In other words, it intended to obtain twice the required

amount of reinsurance and then reduce each underwriter’s line to 50% of what they had promised.

Unfortunately, before it could complete the placing exercise, the insured vessel sank and claims were

made against the reinsurers who, at that time, had agreed to underwrite the risk. In court, one reinsurer

claimed that it should only be obliged to pay an amount based upon the line that it expected to have

after signing down.

The court held that it was obliged to pay the amount that it had actually agreed to pay and for which it

had signed. From the moment the slip is signed, a reinsurance contract is agreed and a reinsurer is

obliged to indemnify the reinsured according to its terms and in the amount specified in the slip until

such time as that slip is amended or otherwise modified.

In situations where reinsurance business is being concluded by fax, email or other non-instantaneous

means, a number of additional issues may arise, including the place and communication of the

acceptance.