Page 62 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 62

3/4 M97/February 2018 Reinsurance

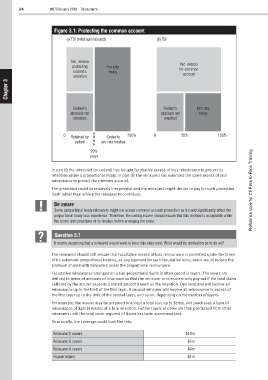

Figure 3.1: Protecting the common account

(i) TSI (total sum insured) (ii) TSI

Fac. excess

protecting Pro rata Fac. excess

cedant’s treaty for common

retention account

3

Chapter

Cedant’s Cedant’s Pro rata

absolute net absolute net treaty

retention retention

0 Retained by Ceded to 100% 0 20% 100%

cedant pro rata treaties

20%

(say)

In part (i) the reinsured (or cedant) has bought facultative excess of loss reinsurance to protect its

retention under a proportional treaty. In part (ii) the reinsured has extended the same excess of loss

reinsurance to protect the common account.

The protection could be relatively inexpensive and the reinsured might decide to pay for such protection Reference copy for CII Face to Face Training

itself rather than asking the reinsurer to contribute.

Be aware

Some proportional treaty reinsurers might not accept common account protection as it could significantly affect the

proportional treaty loss experience. Therefore, the ceding insurer should ensure that this method is acceptable under

the terms and conditions of its treaties before arranging the cover.

Question 3.1

It seems surprising that a reinsured would want to incur this extra cost. What would its motivation be to do so?

The reinsured should still ensure that facultative excess of loss reinsurance is permitted under the terms

of its automatic proportional treaties, as any payment for such facultative reinsurance would reduce the

premium shared with reinsurers under the proportional reinsurance.

Facultative reinsurance arranged on a non-proportional basis is often ceded in layers. The layers are

defined in terms of amounts of insurance so that the reinsurer or reinsurers only pay out if the total claim

suffered by the insurer exceeds a stated amount known as the retention. One reinsurer will receive all

reinsurance up to the limit of the first layer. A second reinsurer will receive all reinsurance in excess of

the first layer up to the limit of the second layer, and so on, depending on the number of layers.

For example, the insurer may be prepared to accept a total loss up to $20m, and purchases a layer of

reinsurance of $4m in excess of a $1m retention. Further layers of cover are then purchased from other

reinsurers until the total cover required of $20m has been accommodated.

Structurally, the coverage could look like this:

Reinsurer C covers $10m

Reinsurer B covers $5m

Reinsurer A covers $4m

Insurer retains $1m