Page 66 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 66

3/8 M97/February 2018 Reinsurance

Example 3.3

A food processing plant is valued at £50m. The insurer seeks facultative excess of loss reinsurance broken down

into three layers:

1st layer £9.5m excess of £500,000.

2nd layer £20m excess of £10m.

3rd layer £20m excess of £30m.

Reinsurers participating on the third layer are liable for an amount equivalent to 40% of the total value (£20m part of

£50m). However, they cannot be exposed to a loss unless it exceeds £30m.

3 Experience tells us that there is a considerable difference in relationship between the total number of claims (the

Chapter frequency of loss) and the size of claims that occur (the severity of loss).

Although the example provides a monetary limit equal to 40% of the total value of the risk, it is unlikely

that the actual claims experience affecting this layer will be 40% of the total claims experience. Only

rarely will a loss occur that gives rise to a claim at this level. This reaffirms the belief that primary

placements are much more likely to be affected by claims, adding to the probability of loss calculations

that the reinsurance underwriter must factor in when costing the provision of cover at lower levels of the

programme.

Research shows that the reinsurer’s claims experience on any one risk decreases significantly as the

Reinsurers of the top

layers of the excess or deductible retained by the reinsured increases. Consequently, the amount of the original

programme will be premium to be paid to excess of loss reinsurers relative to the risk they undertake reduces as the excess

less exposed to a loss

or deductible increases and according to whether any lower layers exist beneath them. Reinsurers of the

top layers of the programme will be less exposed to a loss and, therefore, should expect to receive a

lower premium than those on the bottom layers. We can say that the relationship between the insurer’s

deductible and that part of the total original premium required by the reinsurer is inverse.

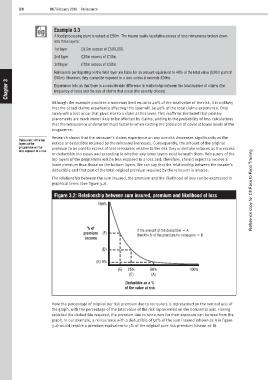

The relationship between the sum insured, the premium and the likelihood of loss can be expressed in

graphical terms (see figure 3.2).

Figure 3.2: Relationship between sum insured, premium and likelihood of loss Reference copy for CII Face to Face Training

100%

% of

premium (F) If the amount of the deductible = A

then the % of the premium for reinsurers = B

income

(D)

(B) 5%

(E) 25% 50% 100%

(C) (A)

Deductible as a %

of the value at risk

Here the percentage of original per risk premium due to reinsurers is represented on the vertical axis of

the graph, with the percentage of the total value of the risk represented on the horizontal axis. Having

selected the deductible required, the premium due to reinsurers for their exposure can be read from the

graph. In our example, a reinsurance with a deductible of 50% of the sum insured (shown as A in figure

3.2) would require a premium equivalent to 5% of the original pure risk premium (shown as B).