Page 68 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 68

3/10 M97/February 2018 Reinsurance

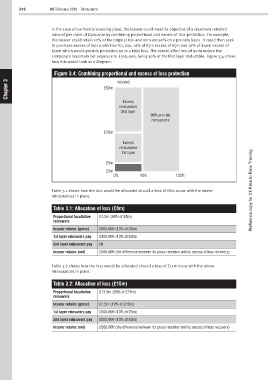

In the case of our food processing plant, the insurer could meet its objective of a maximum retained

amount per claim of £500,000 by combining proportional and excess of loss protection. For example,

the insurer could retain 10% of the original risk and reinsure 90% on a pro-rata basis. It could then seek

to purchase excess of loss protection for, say, 10% of £5m excess of £5m and 10% of £40m excess of

£10m which would provide protection up to a total loss. The overall effect would be to reduce the

company’s maximum net exposure to £500,000, being 10% of the first layer deductible. Figure 3.4 shows

how this would look as a diagram.

Figure 3.4: Combining proportional and excess of loss protection

3 retained

Chapter £50m

Excess

reinsurance

2nd layer

90% pro rata

reinsurance

£10m

Excess

reinsurance

1st layer

£5m

£0m

0% 10% 100%

Table 3.1 shows how the loss would be allocated should a loss of £8m occur with the above Reference copy for CII Face to Face Training

reinsurances in place.

Table 3.1: Allocation of loss (£8m)

Proportional facultative £7.2m (90% of £8m)

reinsurers

Insurer retains (gross) £800,000 (10% of £8m)

1st layer reinsurers pay £300,000 (10% of £3m)

2nd layer reinsurers pay Nil

Insurer retains (net) £500,000 (the difference between its gross retention and its excess of loss recovery)

Table 3.2 shows how the loss would be allocated should a loss of £15m occur with the above

reinsurances in place.

Table 3.2: Allocation of loss (£15m)

Proportional facultative £13.5m (90% of £15m)

reinsurers

Insurer retains (gross) £1.5m (10% of £15m)

1st layer reinsurers pay £500,000 (10% of £5m)

2nd layer reinsurers pay £500,000 (10% of £5m)

Insurer retains (net) £500,000 (the difference between its gross retention and its excess of loss recovery)