Page 12 - Fiscal Year End 2020 Procedures and Cutoff Dates for Client Agencies FINAL

P. 12

U.S. Department of Agriculture

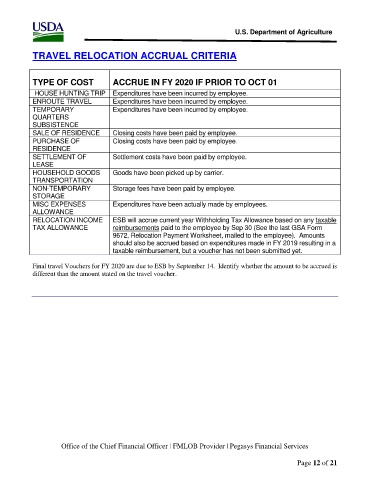

TRAVEL RELOCATION ACCRUAL CRITERIA

TYPE OF COST ACCRUE IN FY 2020 IF PRIOR TO OCT 01

HOUSE HUNTING TRIP Expenditures have been incurred by employee.

ENROUTE TRAVEL Expenditures have been incurred by employee.

TEMPORARY Expenditures have been incurred by employee.

QUARTERS

SUBSISTENCE

SALE OF RESIDENCE Closing costs have been paid by employee.

PURCHASE OF Closing costs have been paid by employee.

RESIDENCE

SETTLEMENT OF Settlement costs have been paid by employee.

LEASE

HOUSEHOLD GOODS Goods have been picked up by carrier.

TRANSPORTATION

NON-TEMPORARY Storage fees have been paid by employee.

STORAGE

MISC EXPENSES Expenditures have been actually made by employees.

ALLOWANCE

RELOCATION INCOME ESB will accrue current year Withholding Tax Allowance based on any taxable

TAX ALLOWANCE reimbursements paid to the employee by Sep 30 (See the last GSA Form

9672, Relocation Payment Worksheet, mailed to the employee). Amounts

should also be accrued based on expenditures made in FY 2019 resulting in a

taxable reimbursement, but a voucher has not been submitted yet.

Final travel Vouchers for FY 2020 are due to ESB by September 14. Identify whether the amount to be accrued is

different than the amount stated on the travel voucher.

Office of the Chief Financial Officer | FMLOB Provider | Pegasys Financial Services

Page 12 of 21