Page 87 - URBAN REDEVELOPMENT PROPOSITIONS - MRT PANTAI STATION

P. 87

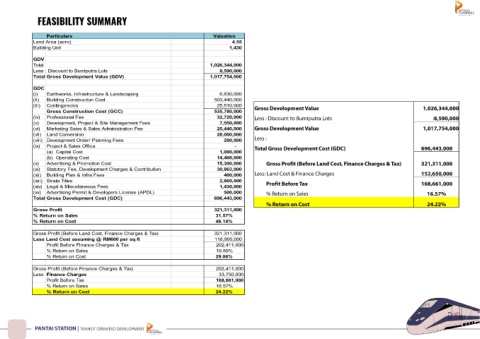

FEASIBILITY SUMMARY

Particulars Valuation

Land Area (acre) 4.55

Building Unit 1,430

GDV

Total 1,026,344,000

Less : Discount to Bumiputra Lots 8,590,000

Total Gross Development Value (GDV) 1,017,754,000

GDC

(i) Earthworks, Infrastructure & Landscaping 6,830,000

(ii) Building Construction Cost 503,440,000

(iii) Contingencies 25,510,000

Gross Construction Cost (GCC) 535,780,000

(iv) Professional Fee 32,720,000

(v) Development, Project & Site Management Fees 7,550,000

(vi) Marketing Sales & Sales Administration Fee 25,440,000

(vii) Land Conversion 28,000,000

(viii) Development Order/ Planning Fees 200,000

(ix) Project & Sales Office -

(a) Capital Cost 1,000,000

(b) Operating Cost 14,400,000

(x) Advertising & Promotion Cost 15,300,000

(xi) Statutory Fee, Development Charges & Contribution 30,863,000

(xii) Building Plan & Infra Fees 400,000

(xiii) Strata Titles 2,860,000

(xiv) Legal & Miscellaneous Fees 1,430,000

(xv) Advertising Permit & Developers License (APDL) 500,000

Total Gross Development Cost (GDC) 696,443,000

Gross Profit 321,311,000

% Return on Sales 31.57%

% Return on Cost 46.14%

Gross Profit (Before Land Cost, Finance Charges & Tax) 321,311,000

Less Land Cost assuming @ RM600 per sq ft 118,900,000

Profit Before Finance Charges & Tax 202,411,000

% Return on Sales 19.89%

% Return on Cost 29.06%

Gross Profit (Before Finance Charges & Tax) 202,411,000

C

h

e

a

e

s

r

g

c

i

Less Land Cost @ RM9 per sq ft 33,750,000

F

n

a

n

Profit Before Tax 168,661,000

% Return on Sales 16.57%

% Return on Cost 24.22%