Page 7 - 6 TIPS FOR CREDIT SCORE

P. 7

6 SIMPLE THINGS YOU

CAN DO TO INCREASE

YOU CREDIT IN SCORE

2021

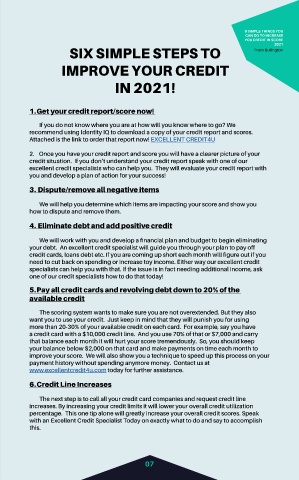

SIX SIMPLE STEPS TO Frank Bullington

IMPROVE YOUR CREDIT

IN 2021!

1. Get your credit report/score now!

If you do not know where you are at how will you know where to go? We

recommend using Identity IQ to download a copy of your credit report and scores.

Attached is the link to order that report now! EXCELLENT CREDIT4U

2. Once you have your credit report and score you will have a clearer picture of your

credit situation. If you don’t understand your credit report speak with one of our

excellent credit specialists who can help you. They will evaluate your credit report with

you and develop a plan of action for your success!

3. Dispute/remove all negative items

We will help you determine which items are impacting your score and show you

how to dispute and remove them.

4. Eliminate debt and add positive credit

We will work with you and develop a financial plan and budget to begin eliminating

your debt. An excellent credit specialist will guide you through your plan to pay off

credit cards, loans debt etc. If you are coming up short each month will figure out if you

need to cut back on spending or increase toy income. Either way our excellent credit

specialists can help you with that. If the issue is in fact needing additional income, ask

one of our credit specialists how to do that today!

5. Pay all credit cards and revolving debt down to 20% of the

available credit

The scoring system wants to make sure you are not overextended. But they also

want you to use your credit. Just keep in mind that they will punish you for using

more than 20-30% of your available credit on each card. For example, say you have

a credit card with a $10,000 credit line. And you use 70% of that or $7,000 and carry

that balance each month it will hurt your score tremendously. So, you should keep

your balance below $2,000 on that card and make payments on time each month to

improve your score. We will also show you a technique to speed up this process on your

payment history without spending anymore money. Contact us at

www.excellentcredit4u.com today for further assistance.

6. Credit Line Increases

The next step is to call all your credit card companies and request credit line

increases. By increasing your credit limits it will lower your overall credit utilization

percentage. This one tip alone will greatly increase your overall credit scores. Speak

with an Excellent Credit Specialist Today on exactly what to do and say to accomplish

this.

07