Page 63 - VCC 2022 Capital Plan New

P. 63

2031

2030

2029

2028

2027

2026

2025

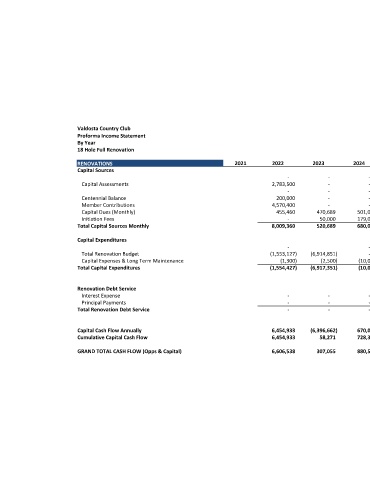

‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ 697,552 683,874 670,465 641,980 604,656 569,407 533,397 501,052 ‐ ‐ 127,500 185,500 184,000 194,000 179,000 179,000 697,552 683,874 797,965 827,480 788,656 763,407

2024

‐ ‐ ‐ ‐ ‐ 470,689 50,000 520,689 (6,914,851) (2,500) (6,917,351) ‐ ‐ ‐ (6,396,662) 58,271 307,055

2023

‐ 2,783,500 ‐ 200,000 4,570,400 455,460 ‐ 8,009,360 ‐ (1,553,127) (1,300) (1,554,427) ‐ ‐ ‐ 6,454,933 6,454,933 6,606,538

2022

2021

Valdosta Country Club Proforma Income Statement By Year 18 Hole Full Renovation RENOVATIONS Capital Sources Capital Assessments Centennial Balance Member Contributions Capital Dues (Monthly) Initiation Fees Total Capital Sources Monthly Capital Expenditures Total Renovation Budget Capital Expenses & Long Term Maintenance Total Capital Expenditures Renovation Debt Service Interest Expense Principal Payments Total Renovation Debt Service Capital Cash Flow Annually Cumulative Capital Cash Flow GRAND TOTAL CASH FLOW (Opps & Capital)