Page 24 - Watkins Associated Industries, Inc - 2022 Benefits Guide

P. 24

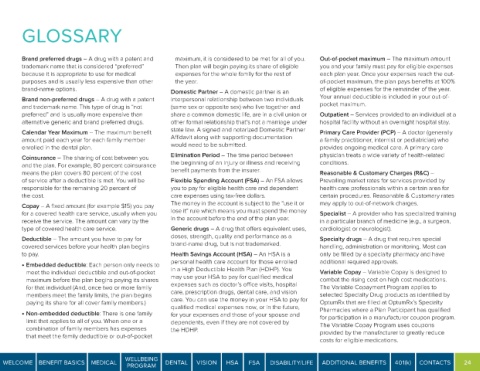

GLOSSARY

Brand preferred drugs – A drug with a patent and maximum, it is considered to be met for all of you. Out-of-pocket maximum – The maximum amount

trademark name that is considered “preferred” Then plan will begin paying its share of eligible you and your family must pay for eligible expenses

because it is appropriate to use for medical expenses for the whole family for the rest of each plan year. Once your expenses reach the out-

purposes and is usually less expensive than other the year. of-pocket maximum, the plan pays benefits at 100%

brand-name options. Domestic Partner – A domestic partner is an of eligible expenses for the remainder of the year.

Brand non-preferred drugs – A drug with a patent interpersonal relationship between two individuals Your annual deductible is included in your out-of-

and trademark name. This type of drug is “not (same sex or opposite sex) who live together and pocket maximum.

preferred” and is usually more expensive than share a common domestic life, are in a civil union or Outpatient – Services provided to an individual at a

alternative generic and brand preferred drugs. other formal relationship that’s not a marriage under hospital facility without an overnight hospital stay.

Calendar Year Maximum – The maximum benefit state law. A signed and notarized Domestic Partner Primary Care Provider (PCP) – A doctor (generally

amount paid each year for each family member Affidavit along with supporting documentation a family practitioner, internist or pediatrician) who

enrolled in the dental plan. would need to be submitted. provides ongoing medical care. A primary care

Coinsurance – The sharing of cost between you Elimination Period – The time period between physician treats a wide variety of health-related

and the plan. For example, 80 percent coinsurance the beginning of an injury or illness and receiving conditions.

means the plan covers 80 percent of the cost benefit payments from the insurer. Reasonable & Customary Charges (R&C) –

of service after a deductible is met. You will be Flexible Spending Account (FSA) – An FSA allows Prevailing market rates for services provided by

responsible for the remaining 20 percent of you to pay for eligible health care and dependent health care professionals within a certain area for

the cost. care expenses using tax-free dollars. certain procedures. Reasonable & Customary rates

Copay – A fixed amount (for example $15) you pay The money in the account is subject to the “use it or may apply to out-of-network charges.

for a covered health care service, usually when you lose it” rule which means you must spend the money Specialist – A provider who has specialized training

receive the service. The amount can vary by the in the account before the end of the plan year. in a particular branch of medicine (e.g., a surgeon,

type of covered health care service. Generic drugs – A drug that offers equivalent uses, cardiologist or neurologist).

Deductible – The amount you have to pay for doses, strength, quality and performance as a Specialty drugs – A drug that requires special

covered services before your health plan begins brand-name drug, but is not trademarked. handling, administration or monitoring. Most can

to pay. Health Savings Account (HSA) – An HSA is a only be filled by a specialty pharmacy and have

personal health care account for those enrolled additional required approvals.

• Embedded deductible: Each person only needs to

meet the individual deductible and out-of-pocket in a High Deductible Health Plan (HDHP). You Variable Copay – Variable Copay is designed to

maximum before the plan begins paying its shares may use your HSA to pay for qualified medical combat the rising cost on high cost medications.

for that individual (And, once two or more family expenses such as doctor’s office visits, hospital The Variable Copayment Program applies to

members meet the family limits, the plan begins care, prescription drugs, dental care, and vision selected Specialty Drug products as identified by

paying its share for all cover family members.) care. You can use the money in your HSA to pay for OptumRx that are filled at OptumRx’s Specialty

qualified medical expenses now, or in the future,

• Non-embedded deductible: There is one family for your expenses and those of your spouse and Pharmacies where a Plan Participant has qualified

limit that applies to all of you. When one or a dependents, even if they are not covered by for participation in a manufacturer coupon program.

combination of family members has expenses the HDHP. The Variable Copay Program uses coupons

that meet the family deductible or out-of-pocket provided by the manufacturer to greatly reduce

costs for eligible medications.

WELLBEING

WELCOME BENEFIT BASICS MEDICAL DENTAL VISION HSA FSA DISABILITY/LIFE ADDITIONAL BENEFITS 401(k) CONTACTS 24

PROGRAM