Page 22 - Watkins Associated Industries, Inc - 2022 Benefits Guide

P. 22

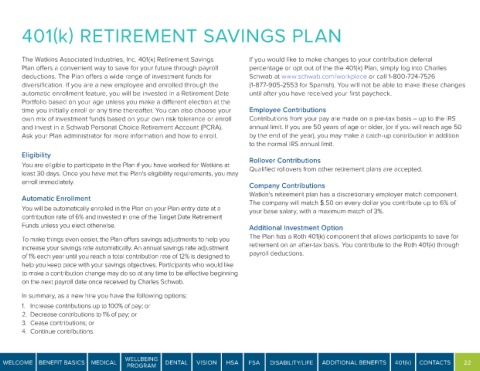

401(k) RETIREMENT SAVINGS PLAN

The Watkins Associated Industries, Inc. 401(k) Retirement Savings If you would like to make changes to your contribution deferral

Plan offers a convenient way to save for your future through payroll percentage or opt out of the the 401(k) Plan, simply log into Charles

deductions. The Plan offers a wide range of investment funds for Schwab at www.schwab.com/workplace or call 1-800-724-7526

diversification. If you are a new employee and enrolled through the (1-877-905-2553 for Spanish). You will not be able to make these changes

automatic enrollment feature, you will be invested in a Retirement Date until after you have received your first paycheck.

Portfolio based on your age unless you make a different election at the

time you initially enroll or any time thereafter. You can also choose your Employee Contributions

own mix of investment funds based on your own risk tolerance or enroll Contributions from your pay are made on a pre-tax basis – up to the IRS

and invest in a Schwab Personal Choice Retirement Account (PCRA). annual limit. If you are 50 years of age or older, (or if you will reach age 50

Ask your Plan administrator for more information and how to enroll. by the end of the year), you may make a catch-up contribution in addition

to the normal IRS annual limit.

Eligibility

You are eligible to participate in the Plan if you have worked for Watkins at Rollover Contributions

Qualified rollovers from other retirement plans are accepted.

least 30 days. Once you have met the Plan's eligibility requirements, you may

enroll immediately. Company Contributions

Automatic Enrollment Watkin's retirement plan has a discretionary employer match component.

The company will match $.50 on every dollar you contribute up to 6% of

You will be automatically enrolled in the Plan on your Plan entry date at a your base salary, with a maximum match of 3%.

contribution rate of 6% and invested in one of the Target Date Retirement

Funds unless you elect otherwise. Additional Investment Option

To make things even easier, the Plan offers savings adjustments to help you The Plan has a Roth 401(k) component that allows participants to save for

increase your savings rate automatically. An annual savings rate adjustment retirement on an after-tax basis. You contribute to the Roth 401(k) through

of 1% each year until you reach a total contribution rate of 12% is designed to payroll deductions.

help you keep pace with your savings objectives. Participants who would like

to make a contribution change may do so at any time to be effective beginning

on the next payroll date once received by Charles Schwab.

In summary, as a new hire you have the following options:

1. Increase contributions up to 100% of pay; or

2. Decrease contributions to 1% of pay; or

3. Cease contributions; or

4. Continue contributions.

WELLBEING

WELCOME BENEFIT BASICS MEDICAL DENTAL VISION HSA FSA DISABILITY/LIFE ADDITIONAL BENEFITS 401(k) CONTACTS 22

PROGRAM