Page 17 - Watkins Associated Industries, Inc - 2022 Benefits Guide

P. 17

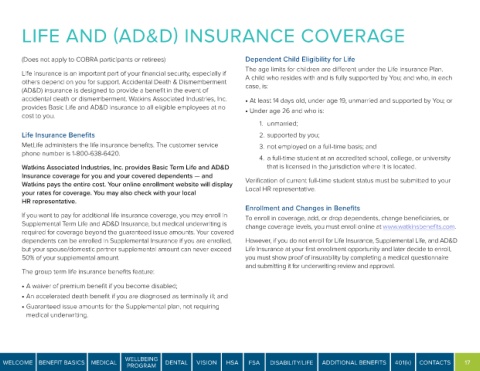

LIFE AND (AD&D) INSURANCE COVERAGE

(Does not apply to COBRA participants or retirees) Dependent Child Eligibility for Life

The age limits for children are different under the Life Insurance Plan.

Life insurance is an important part of your financial security, especially if A child who resides with and is fully supported by You; and who, in each

others depend on you for support. Accidental Death & Dismemberment case, is:

(AD&D) insurance is designed to provide a benefit in the event of

accidental death or dismemberment. Watkins Associated Industries, Inc. • At least 14 days old, under age 19, unmarried and supported by You; or

provides Basic Life and AD&D Insurance to all eligible employees at no • Under age 26 and who is:

cost to you.

1. unmarried;

Life Insurance Benefits 2. supported by you;

MetLife administers the life insurance benefits. The customer service 3. not employed on a full-time basis; and

phone number is 1-800-638-6420.

4. a full-time student at an accredited school, college, or university

Watkins Associated Industries, Inc. provides Basic Term Life and AD&D that is licensed in the jurisdiction where it is located.

Insurance coverage for you and your covered dependents — and

Watkins pays the entire cost. Your online enrollment website will display Verification of current full-time student status must be submitted to your

your rates for coverage. You may also check with your local Local HR representative.

HR representative.

Enrollment and Changes in Benefits

If you want to pay for additional life insurance coverage, you may enroll in To enroll in coverage, add, or drop dependents, change beneficiaries, or

Supplemental Term Life and AD&D Insurance, but medical underwriting is change coverage levels, you must enroll online at www.watkinsbenefits.com.

required for coverage beyond the guaranteed issue amounts. Your covered

dependents can be enrolled in Supplemental Insurance if you are enrolled, However, if you do not enroll for Life Insurance, Supplemental Life, and AD&D

but your spouse/domestic partner supplemental amount can never exceed Life Insurance at your first enrollment opportunity and later decide to enroll,

50% of your supplemental amount. you must show proof of insurability by completing a medical questionnaire

and submitting it for underwriting review and approval.

The group term life insurance benefits feature:

• A waiver of premium benefit if you become disabled;

• An accelerated death benefit if you are diagnosed as terminally ill; and

• Guaranteed issue amounts for the Supplemental plan, not requiring

medical underwriting.

WELLBEING

WELCOME BENEFIT BASICS MEDICAL DENTAL VISION HSA FSA DISABILITY/LIFE ADDITIONAL BENEFITS 401(k) CONTACTS 17

PROGRAM