Page 17 - PetVet 2022 Master Benefits Guide_Final

P. 17

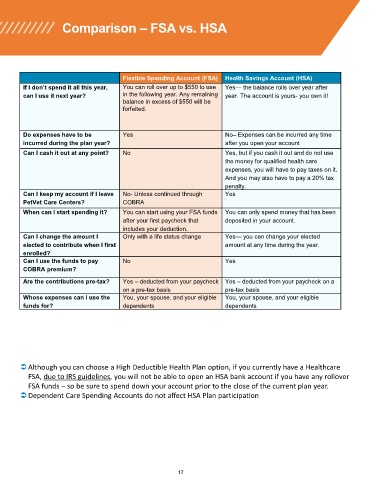

Comparison – FSA vs. HSA

Flexible Spending Account (FSA) Health Savings Account (HSA)

If I don’t spend it all this year, You can roll over up to $550 to use Yes— the balance rolls over year after

can I use it next year? in the following year. Any remaining year. The account is yours- you own it!

balance in excess of $550 will be

forfeited.

Do expenses have to be Yes No– Expenses can be incurred any time

incurred during the plan year? after you open your account

Can I cash it out at any point? No Yes, but if you cash it out and do not use

the money for qualified health care

expenses, you will have to pay taxes on it.

And you may also have to pay a 20% tax

penalty.

Can I keep my account if I leave No- Unless continued through Yes

PetVet Care Centers? COBRA

When can I start spending it? You can start using your FSA funds You can only spend money that has been

after your first paycheck that deposited in your account.

includes your deduction.

Can I change the amount I Only with a life status change Yes— you can change your elected

elected to contribute when I first amount at any time during the year.

enrolled?

Can I use the funds to pay No Yes

COBRA premium?

Are the contributions pre-tax? Yes – deducted from your paycheck Yes – deducted from your paycheck on a

on a pre-tax basis pre-tax basis

Whose expenses can I use the You, your spouse, and your eligible You, your spouse, and your eligible

funds for? dependents dependents

Although you can choose a High Deductible Health Plan option, if you currently have a Healthcare

FSA, due to IRS guidelines, you will not be able to open an HSA bank account if you have any rollover

FSA funds – so be sure to spend down your account prior to the close of the current plan year.

Dependent Care Spending Accounts do not affect HSA Plan participation

17