Page 21 - 2022 CAPREIT Benefits Guide

P. 21

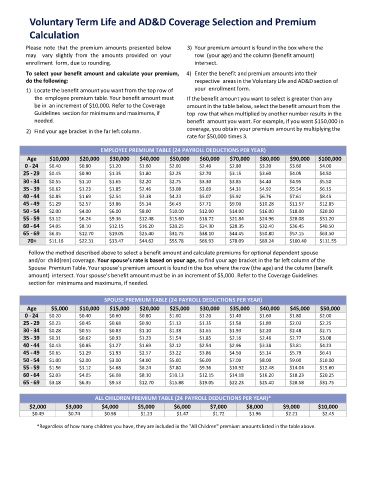

Voluntary Term Life and AD&D Coverage Selection and Premium

Calculation

Please note that the premium amounts presented below 3) Your premium amount is found in the box where the

may vary slightly from the amounts provided on your row (your age) and the column (benefit amount)

enrollment form, due to rounding. intersect.

To select your benefit amount and calculate your premium, 4) Enter the benefit and premium amounts into their

do the following: respective areas in the Voluntary Life and AD&D section of

1) Locate the benefit amount you want from the top row of your enrollment form.

the employee premium table. Your benefit amount must If the benefit amount you want to select is greater than any

be in an increment of $10,000. Refer to the Coverage amount in the table below, select the benefit amount from the

Guidelines section for minimums and maximums, if top row that when multiplied by another number results in the

needed. benefit amount you want. For example, if you want $150,000 in

2) Find your age bracket in the far left column. coverage, you obtain your premium amount by multiplying the

rate for $50,000 times 3.

EMPLOYEE PREMIUM TABLE (24 PAYROLL DEDUCTIONS PER YEAR)

Age $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 $100,000

0 - 24 $0.40 $0.80 $1.20 $1.60 $2.00 $2.40 $2.80 $3.20 $3.60 $4.00

25 - 29 $0.45 $0.90 $1.35 $1.80 $2.25 $2.70 $3.15 $3.60 $4.05 $4.50

30 - 34 $0.55 $1.10 $1.65 $2.20 $2.75 $3.30 $3.85 $4.40 $4.95 $5.50

35 - 39 $0.62 $1.23 $1.85 $2.46 $3.08 $3.69 $4.31 $4.92 $5.54 $6.15

40 - 44 $0.85 $1.69 $2.54 $3.38 $4.23 $5.07 $5.92 $6.76 $7.61 $8.45

45 - 49 $1.29 $2.57 $3.86 $5.14 $6.43 $7.71 $9.00 $10.28 $11.57 $12.85

50 - 54 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 $16.00 $18.00 $20.00

55 - 59 $3.12 $6.24 $9.36 $12.48 $15.60 $18.72 $21.84 $24.96 $28.08 $31.20

60 - 64 $4.05 $8.10 $12.15 $16.20 $20.25 $24.30 $28.35 $32.40 $36.45 $40.50

65 - 69 $6.35 $12.70 $19.05 $25.40 $31.75 $38.10 $44.45 $50.80 $57.15 $63.50

70+ $11.16 $22.31 $33.47 $44.62 $55.78 $66.93 $78.09 $89.24 $100.40 $111.55

Follow the method described above to select a benefit amount and calculate premiums for optional dependent spouse

and/or child(ren) coverage. Your spouse’s rate is based on your age, so find your age bracket in the far left column of the

Spouse Premium Table. Your spouse’s premium amount is found in the box where the row (the age) and the column (benefit

amount) intersect. Your spouse’s benefit amount must be in an increment of $5,000. Refer to the Coverage Guidelines

section for minimums and maximums, if needed.

SPOUSE PREMIUM TABLE (24 PAYROLL DEDUCTIONS PER YEAR)

Age $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 $45,000 $50,000

0 - 24 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 $1.80 $2.00

25 - 29 $0.23 $0.45 $0.68 $0.90 $1.13 $1.35 $1.58 $1.80 $2.03 $2.25

30 - 34 $0.28 $0.55 $0.83 $1.10 $1.38 $1.65 $1.93 $2.20 $2.48 $2.75

35 - 39 $0.31 $0.62 $0.93 $1.23 $1.54 $1.85 $2.16 $2.46 $2.77 $3.08

40 - 44 $0.43 $0.85 $1.27 $1.69 $2.12 $2.54 $2.96 $3.38 $3.81 $4.23

45 - 49 $0.65 $1.29 $1.93 $2.57 $3.22 $3.86 $4.50 $5.14 $5.79 $6.43

50 - 54 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 $9.00 $10.00

55 - 59 $1.56 $3.12 $4.68 $6.24 $7.80 $9.36 $10.92 $12.48 $14.04 $15.60

60 - 64 $2.03 $4.05 $6.08 $8.10 $10.13 $12.15 $14.18 $16.20 $18.23 $20.25

65 - 69 $3.18 $6.35 $9.53 $12.70 $15.88 $19.05 $22.23 $25.40 $28.58 $31.75

ALL CHILDREN PREMIUM TABLE (24 PAYROLL DEDUCTIONS PER YEAR)*

$2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 $10,000

$0.49 $0.74 $0.98 $1.23 $1.47 $1.72 $1.96 $2.21 $2.45

*Regardless of how many children you have, they are included in the "All Children" premium amounts listed in the table above.