Page 5 - Avatar 2022 Flipbook

P. 5

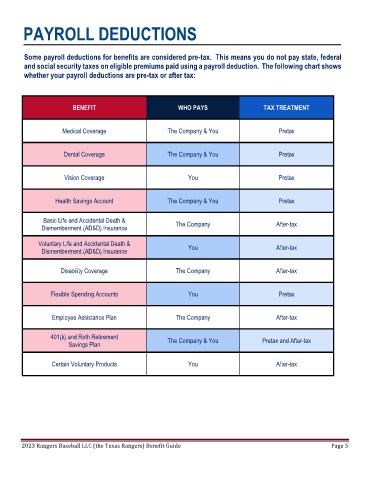

PAYROLL DEDUCTIONS

Some payroll deductions for benefits are considered pre-tax. This means you do not pay state, federal

and social security taxes on eligible premiums paid using a payroll deduction. The following chart shows

whether your payroll deductions are pre-tax or after tax:

BENEFIT WHO PAYS TAX TREATMENT

Medical Coverage The Company & You Pretax

Dental Coverage The Company & You Pretax

Vision Coverage You Pretax

Health Savings Account The Company & You Pretax

Basic Life and Accidental Death &

Dismemberment (AD&D) Insurance The Company After-tax

Voluntary Life and Accidental Death & You After-tax

Dismemberment (AD&D) Insurance

Disability Coverage The Company After-tax

Flexible Spending Accounts You Pretax

Employee Assistance Plan The Company After-tax

401(k) and Roth Retirement The Company & You Pretax and After-tax

Savings Plan

Certain Voluntary Products You After-tax

2023 Rangers Baseball LLC (the Texas Rangers) Benefit Guide Page 5