Page 9 - 2023 SpeciatlyCare Benefit Guide

P. 9

2023 Benefits Guide

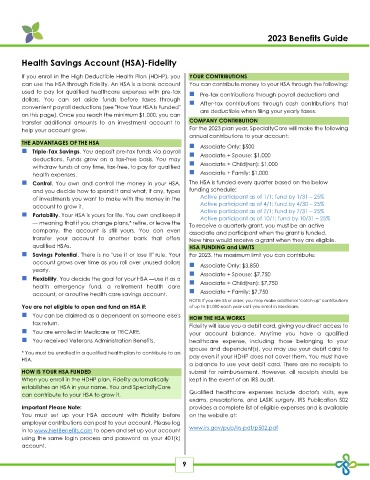

Health Savings Account (HSA)-Fidelity

If you enroll in the High Deductible Health Plan (HDHP), you YOUR CONTRIBUTIONS

can use the HSA through Fidelity. An HSA is a bank account You can contribute money to your HSA through the following:

used to pay for qualified healthcare expenses with pre-tax ◼ Pre-tax contributions through payroll deductions and

dollars. You can set aside funds before taxes through

convenient payroll deductions (see "How Your HSA Is Funded" ◼ After-tax contributions through cash contributions that

are deductible when filing your yearly taxes.

on this page). Once you reach the minimum $1,000, you can

transfer additional amounts to an investment account to COMPANY CONTRIBUTION

help your account grow. For the 2023 plan year, SpecialtyCare will make the following

annual contributions to your account:

THE ADVANTAGES OF THE HSA ◼ Associate Only: $500

◼ Triple-Tax Savings. You deposit pre-tax funds via payroll ◼ Associate + Spouse: $1,000

deductions. Funds grow on a tax-free basis. You may

withdraw funds at any time, tax-free, to pay for qualified ◼ Associate + Child(ren): $1,000

health expenses. ◼ Associate + Family: $1,000

◼ Control. You own and control the money in your HSA, The HSA is funded every quarter based on the below

and you decide how to spend it and what, if any, types funding schedule:

of investments you want to make with the money in the Active participant as of 1/1; fund by 1/31 – 25%

account to grow it. Active participant as of 4/1; fund by 4/30 – 25%

◼ Portability. Your HSA is yours for life. You own and keep it Active participant as of 7/1; fund by 7/31 – 25%

Active participant as of 10/1; fund by 10/31 – 25%

— meaning that if you change plans,* retire, or leave the To receive a quarterly grant, you must be an active

company, the account is still yours. You can even associate and participant when the grant is funded.

transfer your account to another bank that offers New hires would receive a grant when they are eligible.

qualified HSAs. HSA FUNDING and LIMITS

◼ Savings Potential. There is no "use it or lose it" rule. Your For 2023, the maximum limit you can contribute:

account grows over time as you roll over unused dollars ◼ Associate Only: $3,850

yearly.

◼ Flexibility. You decide the goal for your HSA —use it as a ◼ Associate + Spouse: $7,750

health emergency fund, a retirement health care ◼ Associate + Child(ren): $7,750

account, or a routine health care savings account. ◼ Associate + Family: $7,750

NOTE: If you are 55 or older, you may make additional "catch-up" contributions

You are not eligible to open and fund an HSA if: of up to $1,000 each year until you enroll in Medicare.

◼ You can be claimed as a dependent on someone else's HOW THE HSA WORKS

tax return.

Fidelity will issue you a debit card, giving you direct access to

◼ You are enrolled in Medicare or TRICARE. your account balance. Anytime you have a qualified

◼ You received Veterans Administration Benefits. healthcare expense, including those belonging to your

spouse and dependent(s), you may use your debit card to

* You must be enrolled in a qualified health plan to contribute to an pay even if your HDHP does not cover them. You must have

HSA.

a balance to use your debit card. There are no receipts to

HOW IS YOUR HSA FUNDED submit for reimbursement. However, all receipts should be

When you enroll in the HDHP plan, Fidelity automatically kept in the event of an IRS audit.

establishes an HSA in your name. You and SpecialtyCare

can contribute to your HSA to grow it. Qualified healthcare expenses include doctor's visits, eye

exams, prescriptions, and LASIK surgery. IRS Publication 502

Important Please Note: provides a complete list of eligible expenses and is available

You must set up your HSA account with Fidelity before on the website at:

employer contributions can post to your account. Please log

in to www.NetBenefits.com to open and set up your account www.irs.gov/pub/irs-pdf/p502.pdf

using the same login process and password as your 401(k)

account.

9