Page 6 - Impact Floors 2022 Benefit Guide

P. 6

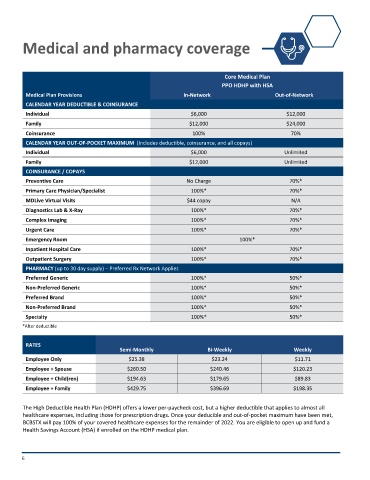

Medical and pharmacy coverage

Core Medical Plan

PPO HDHP with HSA

Medical Plan Provisions In-Network Out-of-Network

CALENDAR YEAR DEDUCTIBLE & COINSURANCE

Individual $6,000 $12,000

Family $12,000 $24,000

Coinsurance 100% 70%

CALENDAR YEAR OUT-OF-POCKET MAXIMUM (Includes deductible, coinsurance, and all copays)

Individual $6,000 Unlimited

Family $12,000 Unlimited

COINSURANCE / COPAYS

Preventive Care No Charge 70%*

Primary Care Physician/Specialist 100%* 70%*

MDLive Virtual Visits $44 copay N/A

Diagnostics Lab & X-Ray 100%* 70%*

Complex Imaging 100%* 70%*

Urgent Care 100%* 70%*

Emergency Room 100%*

Inpatient Hospital Care 100%* 70%*

Outpatient Surgery 100%* 70%*

PHARMACY (up to 30 day supply) – Preferred Rx Network Applies

Preferred Generic 100%* 50%*

Non-Preferred Generic 100%* 50%*

Preferred Brand 100%* 50%*

Non-Preferred Brand 100%* 50%*

Specialty 100%* 50%*

*After deductible

RATES

Semi-Monthly Bi-Weekly Weekly

Employee Only $25.38 $23.24 $11.71

Employee + Spouse $260.50 $240.46 $120.23

Employee + Child(ren) $194.63 $179.65 $89.83

Employee + Family $429.75 $396.69 $198.35

The High Deductible Health Plan (HDHP) offers a lower per-paycheck cost, but a higher deductible that applies to almost all

healthcare expenses, including those for prescription drugs. Once your deducible and out-of-pocket maximum have been met,

BCBSTX will pay 100% of your covered healthcare expenses for the remainder of 2022. You are eligible to open up and fund a

Health Savings Account (HSA) if enrolled on the HDHP medical plan.

6