Page 5 - 2022 Benefit Guide Fives Inc

P. 5

Medical Coverage

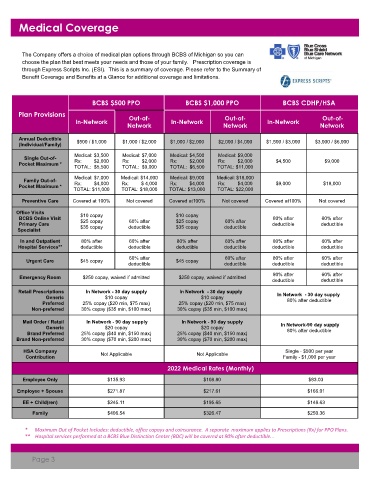

The Company offers a choice of medical plan options through BCBS of Michigan so you can

choose the plan that best meets your needs and those of your family. Prescription coverage is

through Express Scripts Inc. (ESI). This is a summary of coverage. Please refer to the Summary of

Benefit Coverage and Benefits at a Glance for additional coverage and limitations.://www.express-

scripts.com/

BCBS $500 PPO BCBS $1,000 PPO BCBS CDHP/HSA

Plan Provisions Out-of- Out-of- Out-of-

In-Network In-Network In-Network

Network Network Network

Annual Deductible $500 / $1,000 $1,000 / $2,000 $1,000 / $2,000 $2,000 / $4,000 $1,500 / $3,000 $3,000 / $6,000

(Individual/Family)

Medical: $3,500 Medical: $7,000 Medical: $4,500 Medical: $9,000

Single Out-of-

Pocket Maximum * Rx: $2,000 Rx: $2,000 Rx: $2,000 Rx: $2,000 $4,500 $9,000

TOTAL: $5,500 TOTAL: $9,000 TOTAL: $6,500 TOTAL: $11,000

Medical: $7,000 Medical: $14,000 Medical: $9,000 Medical: $18,000

Family Out-of-

Pocket Maximum * Rx: $4,000 Rx: $ 4,000 Rx: $4,000 Rx: $4,000 $9,000 $18,000

TOTAL: $11,000 TOTAL: $18,000 TOTAL: $13,000 TOTAL: $22,000

Preventive Care Covered at 100% Not covered Covered at100% Not covered Covered at100% Not covered

Office Visits $10 copay $10 copay

BCBS Online Visit 80% after 60% after

Primary Care $25 copay 60% after $25 copay 60% after deductible deductible

Specialist $35 copay deductible $35 copay deductible

In and Outpatient 80% after 60% after 80% after 60% after 80% after 60% after

Hospital Services** deductible deductible deductible deductible deductible deductible

60% after 60% after 80% after 60% after

Urgent Care $45 copay $45 copay

deductible deductible deductible deductible

80% after 60% after

Emergency Room $250 copay, waived if admitted $250 copay, waived if admitted

deductible deductible

Retail Prescriptions In Network - 30 day supply In Network - 30 day supply In Network - 30 day supply

Generic $10 copay $10 copay

Preferred 25% copay ($20 min, $75 max) 25% copay ($20 min, $75 max) 80% after deductible

Non-preferred 30% copay ($35 min, $100 max) 30% copay ($35 min, $100 max)

Mail Order / Retail In Network - 90 day supply In Network - 90 day supply In Network-90 day supply

Generic $20 copay $20 copay

Brand Preferred 25% copay ($40 min, $150 max) 25% copay ($40 min, $150 max) 80% after deductible

Brand Non-preferred 30% copay ($70 min, $200 max) 30% copay ($70 min, $200 max)

HSA Company Not Applicable Not Applicable Single - $500 per year

Contribution Family - $1,000 per year

2022 Medical Rates (Monthly)

(bi-weekly)

Employee Only $135.93 $108.80 $83.03

Employee + Spouse $271.87 $217.61 $166.01

EE + Child(ren) $245.11 $195.65 $148.63

Family $406.54 $326.47 $250.36

* Maximum Out of Pocket Includes: deductible, office copays and coinsurance. A separate maximum applies to Prescriptions (Rx) for PPO Plans.

** Hospital services performed at a BCBS Blue Distinction Center (BDC) will be covered at 90% after deductible. .

Page 3