Page 5 - 2022 CPI Card Benefits Guide

P. 5

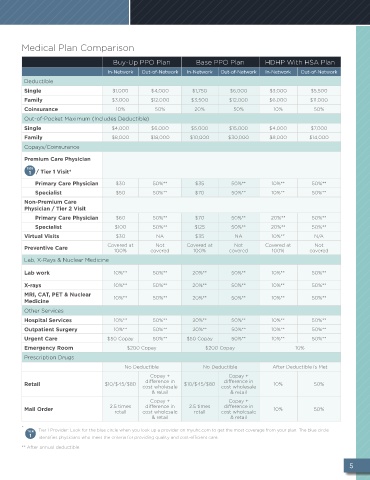

Medical Plan Comparison

Buy-Up PPO Plan Base PPO Plan HDHP With HSA Plan

In-Network Out-of-Network In-Network Out-of-Network In-Network Out-of-Network

Deductible

Single $1,000 $4,000 $1,750 $6,000 $3,000 $5,500

Family $3,000 $12,000 $3,500 $12,000 $6,000 $11,000

Coinsurance 10% 50% 20% 50% 10% 50%

Out-of-Pocket Maximum (Includes Deductible)

Single $4,000 $6,000 $5,000 $15,000 $4,000 $7,000

Family $8,000 $18,000 $10,000 $30,000 $8,000 $14,000

Copays/Coinsurance

Premium Care Physician

/ Tier 1 Visit*

Primary Care Physician $30 50%** $35 50%** 10%** 50%**

Specialist $50 50%** $70 50%** 10%** 50%**

Non-Premium Care

Physician / Tier 2 Visit

Primary Care Physician $60 50%** $70 50%** 20%** 50%**

Specialist $100 50%** $125 50%** 20%** 50%**

Virtual Visits $30 NA $35 NA 10%** N/A

Not

Not

Not

Preventive Care Covered at covered Covered at covered Covered at covered

100%

100%

100%

Lab, X-Rays & Nuclear Medicine

Lab work 10%** 50%** 20%** 50%** 10%** 50%**

X-rays 10%** 50%** 20%** 50%** 10%** 50%**

MRI, CAT, PET & Nuclear

Medicine 10%** 50%** 20%** 50%** 10%** 50%**

Other Services

Hospital Services 10%** 50%** 20%** 50%** 10%** 50%**

Outpatient Surgery 10%** 50%** 20%** 50%** 10%** 50%**

Urgent Care $50 Copay 50%** $50 Copay 50%** 10%** 50%**

Emergency Room $200 Copay $200 Copay 10%

Prescription Drugs

No Deductible No Deductible After Deductible is Met

Copay + Copay +

difference in

difference in

Retail $10/$45/$80 cost wholesale $10/$45/$80 cost wholesale 10% 50%

& retail & retail

Copay + Copay +

difference in

difference in

Mail Order 2.5 times cost wholesale 2.5 times cost wholesale 10% 50%

retail

retail

& retail & retail

*

Tier 1 Provider: Look for the blue circle when you look up a provider on myuhc.com to get the most coverage from your plan. The blue circle

identifies physicians who meet the criteria for providing quality and cost-efficient care.

** After annual deductible.

5