Page 4 - Ampact 2022 Benefit Guide

P. 4

Benefit Basics

ELIGIBILITY For more information about

You are eligible for benefits if you are a regular

employee who works at least 20 hours per week. your benefits, please contact:

Temporary employees who work at least 30 hours

per week are eligible for medical benefits only. Sarah Evans

Most of your benefits are effective on the first day

of the month following your date of hire. Your Benefits Manager and Human

dependents can also enroll for coverage, Resources Partner

including:

• Your legal spouse 612-470-3220

• Your same or opposite sex domestic partner benefits@ampact.us

• Your children up to age 26-regardless of

marital or student status.

Your benefits will take effect on August 1, 2022 Benefit Costs

and will remain in effect until July 31, 2023.

QUALIFYING LIFE EVENTS

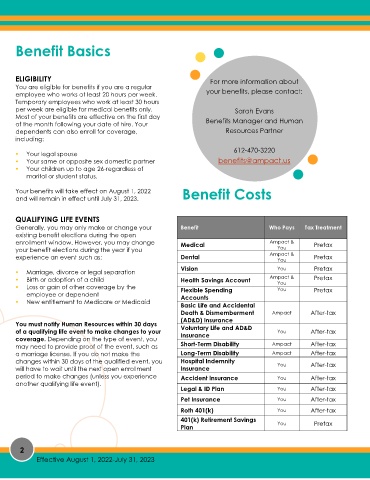

Generally, you may only make or change your Benefit Who Pays Tax Treatment

existing benefit elections during the open

enrollment window. However, you may change Medical Ampact & Pretax

your benefit elections during the year if you You

experience an event such as: Dental Ampact & Pretax

You

• Marriage, divorce or legal separation Vision You Pretax

• Birth or adoption of a child Health Savings Account Ampact & Pretax

• Loss or gain of other coverage by the Flexible Spending You Pretax

You

employee or dependent

• New entitlement to Medicare or Medicaid Accounts

Basic Life and Accidental

Death & Dismemberment Ampact After-tax

(AD&D) Insurance

You must notify Human Resources within 30 days

of a qualifying life event to make changes to your Voluntary Life and AD&D You After-tax

Insurance

coverage. Depending on the type of event, you

may need to provide proof of the event, such as Short-Term Disability Ampact After-tax

a marriage license. If you do not make the Long-Term Disability Ampact After-tax

changes within 30 days of the qualified event, you Hospital Indemnity You After-tax

will have to wait until the next open enrollment Insurance

period to make changes (unless you experience Accident Insurance You After-tax

another qualifying life event).

Legal & ID Plan You After-tax

Pet Insurance You After-tax

Roth 401(k) You After-tax

401(k) Retirement Savings Pretax

Plan You

4

2

Effective August 1, 2022-July 31, 2023